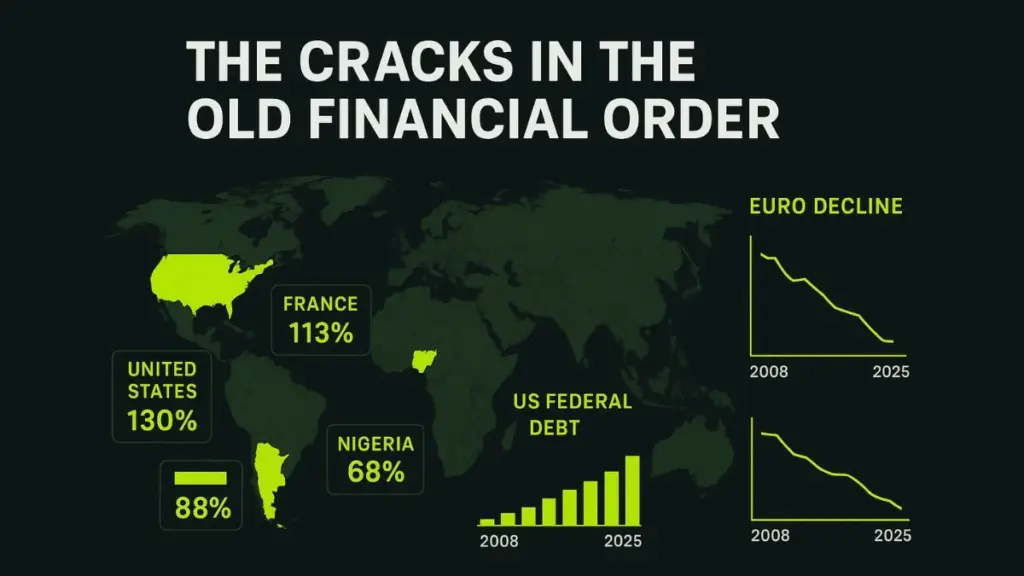

I’ve been thinking about stablecoins a lot lately. They’re not just another crypto fad; they’re turning into the backbone of global finance. You can see it everywhere. Governments are drowning in debt, currencies are collapsing in some countries, and even the euro, which used to feel untouchable, is starting to wobble. Against that backdrop, stablecoins aren’t “if”; they’re “when.”

Look at the U.S., for example. The debt’s now past $37 trillion, and people aren’t exactly lining up to buy long-term government bonds anymore. Interest rate risk and duration risk nobody wants to carry that. So what’s the alternative? Tokenized treasuries.

Dollar-backed stablecoins. Tools that let governments package debt in a way people will actually hold. Once they lean on stablecoins, the supply and legitimacy of these things could just explode.

And it’s not just about access anymore; it’s about returns. Stablecoins that pay yield are here, and that changes the game. Imagine holding digital dollars that are not only stable but also paying you a return that beats a bank savings account. Why wouldn’t people move? That’s when stablecoins go from being “crypto toys” to being the obvious choice.

But honestly, the real story isn’t Wall Street or Washington. It’s the billions of people stuck with currencies that bleed value every week. Argentina, Nigeria, Turkey, Lebanon the list goes on. People don’t need a lecture about inflation; they live it. What they need is a way to hold dollars without jumping through impossible hoops. Stablecoins give them that. And when the big tech players Musk, Zuck, and Bezos roll out super apps that make stablecoins as easy to send as a WhatsApp message? Billions of people are suddenly onboarded overnight. That’s when adoption goes into overdrive.

Even Europe isn’t immune. France is in trouble, with a political mess, ballooning debt, downgrades from ratings agencies, and it’s dragging the euro’s credibility down with it. For the first time in years, people are asking if the euro is really as solid as we thought.

And when confidence cracks in a currency that big, people look for safety. Increasingly, that safety is in dollar stablecoins. If the euro stumbles, that could light up a whole new hype cycle in stables, this time right in the middle of the developed world.

And here’s the kicker: once stablecoins reach scale, everything gets built on top of them. Just like stock markets create room for derivatives and crazy products, stablecoins will spawn their own wave of new instruments and services. They won’t just be money; they’ll be the foundation for the next financial stack.

That’s exactly where oneBanking fits in. We’re building an app that ties all of this together. Fiat, stablecoins, and crypto all in one place, with no jumping between apps. But more than that, we’ve built AI into the core so it actually makes sense of your money. It shows you what’s left after bills, what’s coming up, and where you can save or invest, all without the stress. It’s like having someone in your pocket who knows your finances inside out and saves you time every day.

Stablecoins are just getting warmed up. Governments will need them, corporations will push them, billions of people will adopt them, and even the euro might end up competing with them. The whole thing is only going one way. And when it does, people won’t just need access. They’ll need a platform that makes it simple, safe, and useful.

That’s why we’re building oneBanking. Not to chase a trend, but to be ready for the biggest financial shift of our time and to help people actually benefit from it.