Ready to rethink how you handle your money? If you’ve ever felt frustrated by long bank queues or those clunky, old-school banking apps, you’re not alone. Welcome to the digital banking revolution, where fintech innovation is making everything about finance easier, faster, and a whole lot more enjoyable. And here’s a stat to kick things off: 85% of European banking customers who are online adults use mobile banking apps monthly or more frequently (Business Reporter). That’s proof that customer experience and financial technology disruption are now priorities for countless people across Europe. The oneBanking app is leading this charge, creating a new normal where banks just can’t keep up.

The Core of the Digital Banking Revolution

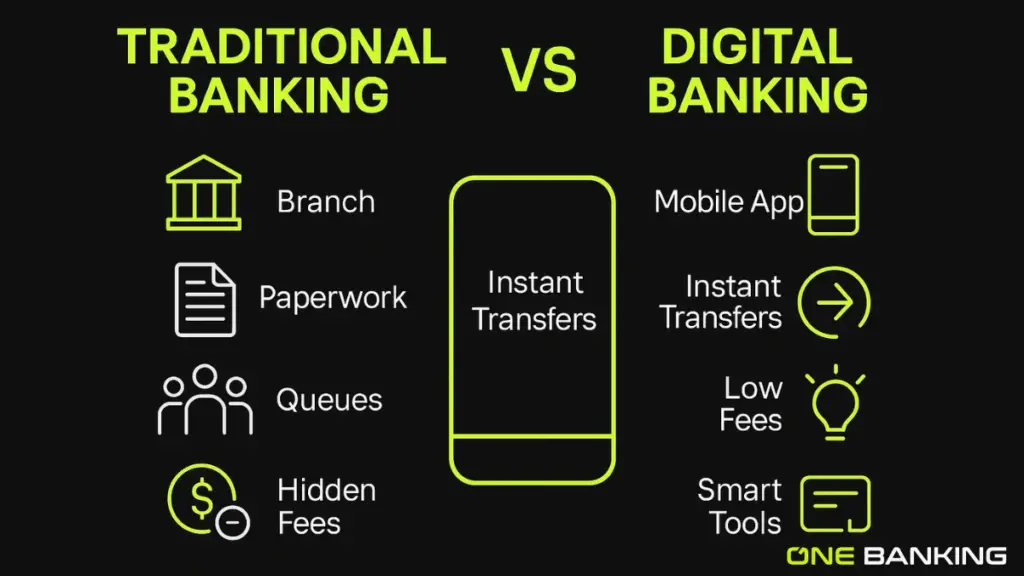

Let’s get real: traditional banks have mostly stuck to their old habits. Mailing forms, fixed opening hours, and complicated processes have been the norm. Sure, they’ve been reliable, but adapting to modern life hasn’t exactly been their strength.

Enter fintech apps, designed from scratch for today’s world. No need for a time machine; open an account, pay bills, or send money abroad whenever and wherever you want. You’re fully in control, using one sleek platform that actually works with your busy schedule. It’s not about patching old systems anymore; it’s about reinventing banking around your lifestyle.

Fintech Innovation: So Much More Than Just an App

What’s behind the rise of fintech? It’s a mix of smart tech and a fearless approach to shaking up the status quo. Traditional banks often get stuck in the mud with legacy computer systems and endless paperwork. Fintech companies, on the other hand, are moving at lightning speed, always looking for better ways to help you with your money.

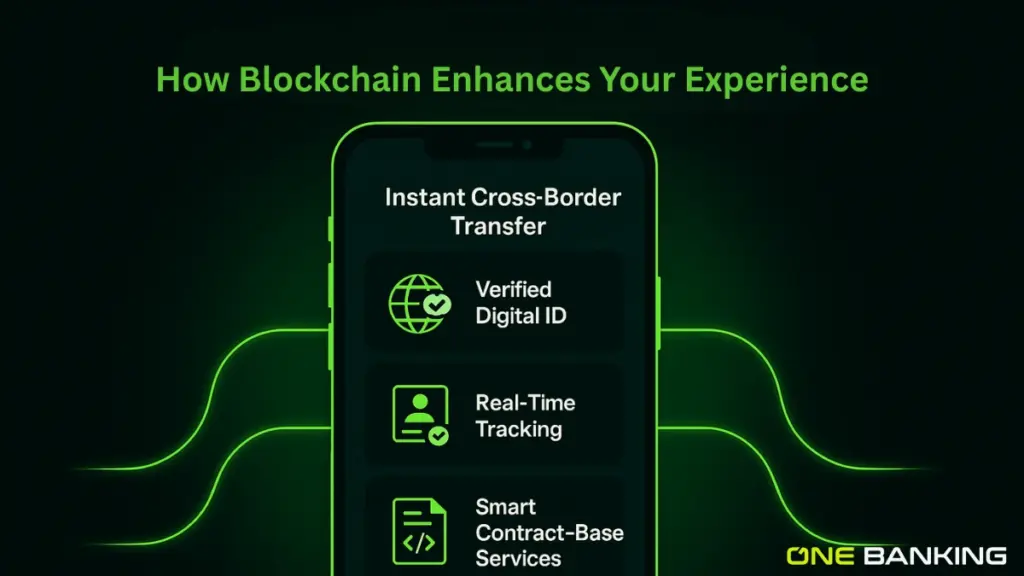

For example, look at AI. Imagine having a money coach on your phone who keeps track of your spending, suggests ways to save, and even gives you personalized advice. This isn’t some vision of the future; it’s what oneBanking is already bringing to your pocket, complete with robust security and privacy.

With oneBanking, you can handle both your FIAT and crypto accounts. You may also use Google Pay and Apple Pay (coming soon) to pay, and you can earn rewards for every action you take in the app. oneBanking puts everything you need in one safe spot. It has low-fee crypto exchanges, Visa cards, and digital wallets, as well as AI-powered budgeting and financial advice. It’s the best, safest, and most profitable way to keep all of your money in one place with trusted partners like BVNK, VISA, Coinbase, OKX, and Tangem.

Why Europeans Love the Modern Customer Experience

Here’s the secret sauce: fintech apps are obsessed with giving you the best possible customer experience. Forget the painful days-long waits or mountains of paperwork. Now, opening an account takes minutes, not hours. Need to send money, even internationally? Just a few taps and it’s done.

What makes this even better is how fintech firms truly listen. Your feedback isn’t an afterthought; it’s central to how new features are designed. At oneBanking, the app evolves based on what users want, not just what executives decide in a boardroom.

And then there are the perks. A lot of fintech apps reward you for things you do anyway, like everyday banking, spending, or trading crypto. You will notice points add up and get genuine discounts over time. Another huge win is that the prices are clear and there are no hidden fees. You always know exactly what you’re paying for.

Fintech Apps vs. Traditional Banks: What’s the Real Difference?

Check out how things stack up when you look at the features side by side:

| Feature | Traditional Banks | Fintech Apps (like oneBanking) |

|---|---|---|

| Accessibility | Limited by opening hours and physical locations | 24/7 access anywhere on your smartphone |

| Account Opening | Lots of paperwork and in-branch visits | Fully digital with a fast, user-friendly process |

| Customer Service | Slow responses, call centers | Instant in-app chat and vibrant online communities |

| Innovation | Slow tech rollouts, clunky systems | Fast updates, AI-powered tools, and ongoing improvements |

| Fees | Complex and often hidden | Clear, fair, and usually lower fees |

| User Experience | Outdated apps and websites | Clean, intuitive design anyone can use |

| Services | Siloed (bank, investments, crypto), all separate | Everything in one app (Fiat, investments, crypto, rewards) all together |

How Financial Technology Is Changing Banking for Good

What’s really exciting is how fintech isn’t just improving banking; it’s changing the whole industry. By tapping into the latest technology and thinking with a fresh perspective, fintech apps deliver services that are quicker, more affordable, and a lot more convenient. Traditional banks are trying to catch up, but it’s a race where fintech holds the upper hand.

You might be wondering, what about security? Rightly so! Fintech leaders like oneBanking haven’t cut corners here. Your money and data are protected thanks to strong partnerships with leading licensed providers and the use of sophisticated encryption. So you get the innovation you want and the safety you need.

Conclusion

Making the switch to a fintech app isn’t just a tech trend in Europe; it’s a smart, practical move for anyone who wants to make the most of their money. The Digital Banking Revolution is here, fueled by constant Fintech innovation and a focus on what matters most to you: a great customer experience.

oneBanking is here to help you survive if you want banking software that keeps things simple, allows you to manage both crypto and regular accounts in one place, gives you smart tools powered by AI, and even pays you for your everyday banking. Welcome to the future of banking, where everything is simple, safe, and made to fit your requirements.

FAQs:

Q. Are fintech apps as secure as traditional banks?

Absolutely. Top finance apps use robust data encryption and licensed partners to ensure security. With oneBanking, your information is always protected.

Q. Can I ditch my traditional bank for a fintech app?

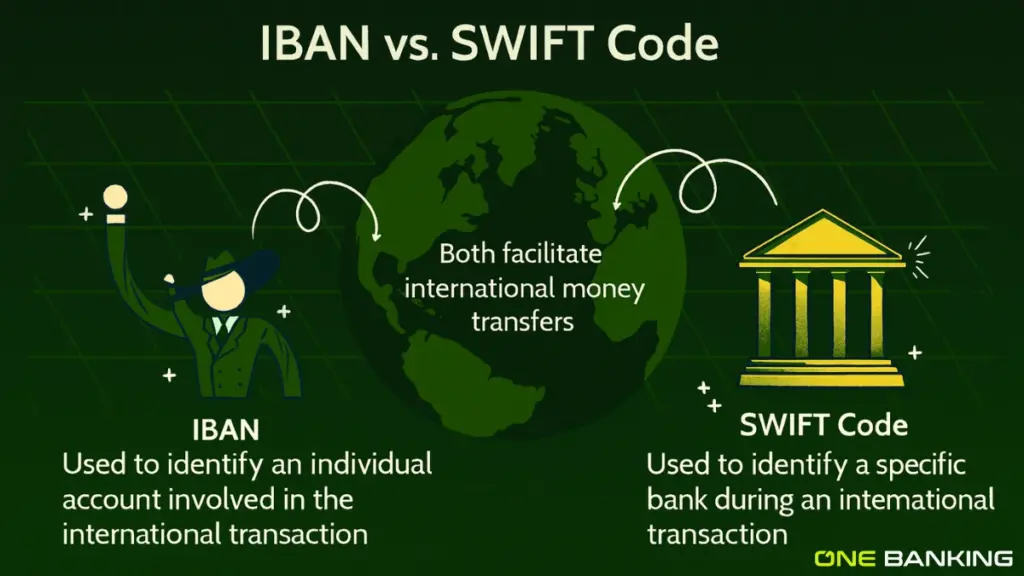

Definitely. More Europeans are switching every year because apps now offer everything from IBAN accounts and Visa cards to instant payments and investing, all in one place.

Q. What are the big perks of using a fintech app?

You’ll enjoy how free, easy, and clear it is. You can bank whenever you choose, with simple and fair costs and smart features like AI-driven tips and rewards.

Q. Is it easy to switch over?

Yes, it’s usually a breeze. Fintech apps like oneBanking walk you through the process step by step, help with transferring your funds, and offer helpful support whenever you need it.