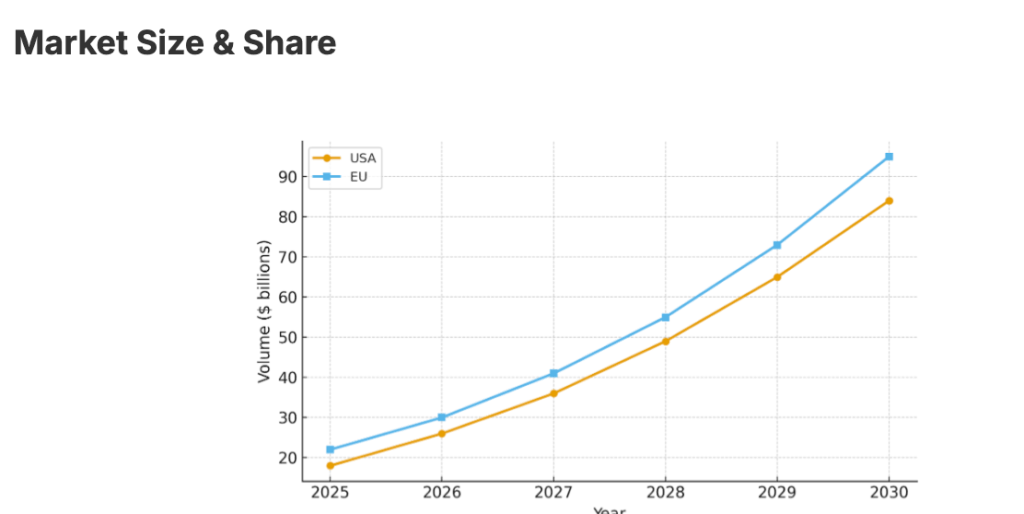

We have to admit that finance isn’t what it used to be. As a business owner, you desire flexibility, strong security, and the ability to reach clients and partners anywhere in the world. Here’s an eye-opening statistic: 22% of surveyed European businesses have accepted cryptocurrency payments at least once, and 12% accept them regularly. Crypto banking accounts, especially through forward-thinking providers like oneBanking, aren’t just optional; they’re rapidly becoming a key competitive capability for modern businesses. Meanwhile, Transcript IQ’s projections suggest that merchant crypto acceptance in the EU could grow from around 34% today to over 60% by 2030.

So why is this move so important? In this article, we’ll explore how a crypto banking account can give your business a genuine competitive edge. Get ready for lightning-fast payments, fortified security, truly global reach, and effortless digital asset management. Discover just how simple it is to embrace the future of business finance.

Source: Transcript IQ

How Has Banking Evolved to Empower Your Business?

Do you remember when doing business banking meant standing in long lines and dealing with a lot of paperwork? Traditional methods worked but also made it hard to do business on a worldwide scale. International payments took forever, costs ate into your profits, and getting help outside of normal business hours frequently felt impossible.

Enter crypto banking for businesses, powered by blockchain technology. Today, you can send and receive money at the speed of the market while minimizing costs. It’s not about replacing your trusted bank; it’s about empowering your business with cutting-edge financial flexibility.

Why Savvy Leaders Are Turning to Crypto Banking?

Have you ever thought about why so many smart businesspeople are getting into crypto banking? Let’s look at the main perks.

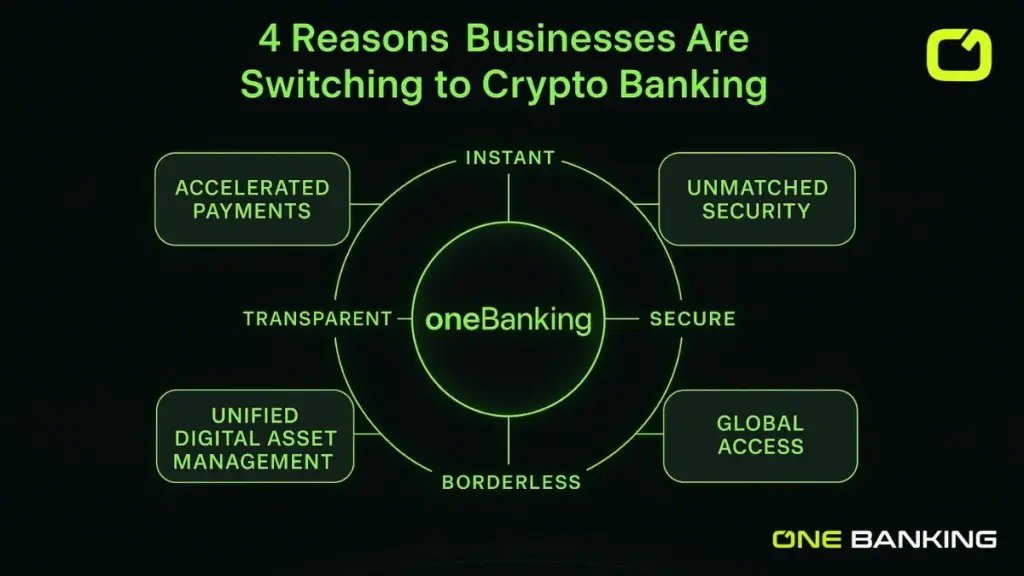

1. Accelerated Payments, Lower Costs, Worldwide

If you’re tired of waiting days for a wire transfer or watching unnecessary service charges pile up, crypto is your answer. Payments clear in minutes, and costs are typically far lower than those imposed by traditional banks. Whether you’re working with international vendors or welcoming global clients, blockchain banking solutions let you move capital with unmatched speed and value.

2. Unparalleled Security and Full Transparency

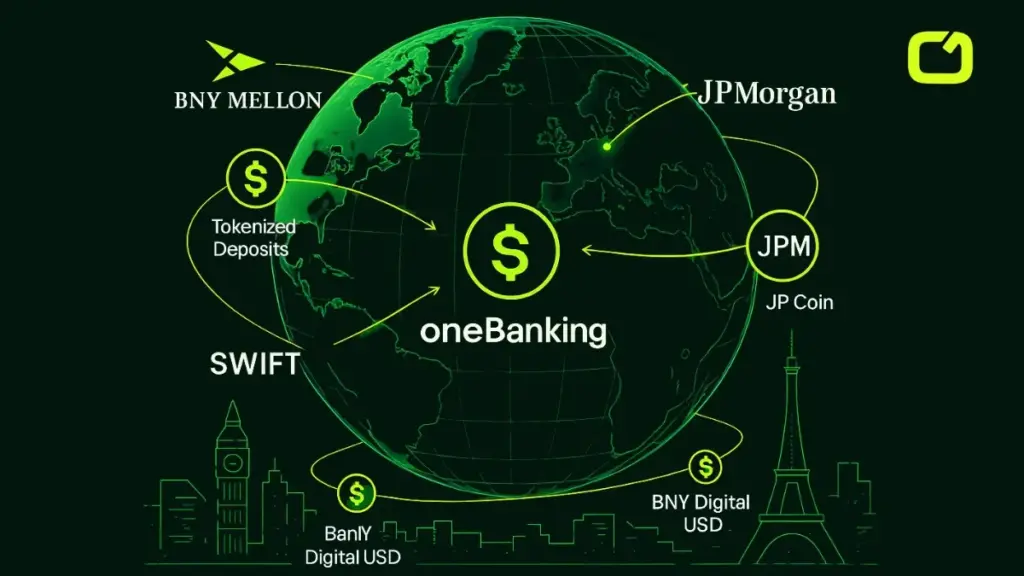

Every business transaction must be secure. Thus, blockchain records every move transparently and tamper-proof. With oneBanking and our commitment to advanced security, from partnerships with the industry’s top innovators to robust encryption. That says your digital asset management for entrepreneurs remains protected 24/7.

3. A Gateway to the Global Marketplace

Millions run businesses and shop online without ever using a traditional bank. They do, however, use smartphones and engage in the digital economy. When you open a business crypto account, you can service consumers all around the world without having to worry about hidden fees or exchange rates. Real, practical growth propelled by diversity and accessibility will let you see new things.

4. Consolidate All Digital Assets with Ease

As your business expands, you’ll likely manage an ever-widening range of assets, from cryptocurrencies like Bitcoin and Ethereum to familiar fiat currencies—and soon, even more investment options. Instead of hopping from one platform to another, consolidate everything within oneBanking. Monitor, buy, sell, send, or receive in a single intuitive dashboard. Now, digital asset management for entrepreneurs is convenient, organized, and accessible.

Traditional vs. Crypto Business Accounts: Making the Choice Clear

Let’s compare how these account types measure up:

| Feature | Traditional Business Account | Crypto Business Account |

|---|---|---|

| Transaction Speed | 1 to 5 business days for global wires | Minutes; real-time worldwide transfers |

| Transaction Fees | High, especially on international payments | Low; just network fees, no hidden surprises |

| Accessibility | Bank hours and physical locations limit access | Available 24/7 from any device with internet |

| Transparency | Limited; bank controls information | Every transaction recorded on blockchain for clarity |

| Asset Types | Primarily fiat currencies | Crypto, stablecoins, fiat, and soon more investments |

| Global Reach | Restricted by banking networks | Truly borderless—connect with anyone, anywhere |

Why Is oneBanking the Strategic Choice for Modern Businesses?

Not all crypto banking platforms put business needs first. To maximize blockchain banking solutions, you need a partner with advanced technology, security, simplicity, and reliability.

That’s where oneBanking truly stands apart. Crafted with forward-thinking professionals in mind, oneBanking merges the best of traditional banking and modern digital finance. Enjoy low transaction fees, a rewarding customer loyalty program, and seamless integration with your existing tools—all backed by a network of highly reputable technology partners. Our mission is to make crypto banking for businesses smooth and empowering, giving you the peace of mind and agility to focus on what matters most: growing your business. Plus, as we expand, you’ll gain access to even more features, including business cards and additional investment opportunities, so your business always stays ahead.

Conclusion

Business finance is changing at an amazing rate. The businesses that will do well in the future will be the ones that are ready to use a crypto banking account today, which offers speedier payments, rock-solid security, and endless development possibilities.

Are you ready to be in charge? Pick oneBanking as your partner and get the help, knowledge, and cutting-edge technology you need to improve your business’s finances in the digital age. Get a smarter, more flexible way to bank that was made for business owners like you.

FAQs

Q. What is a crypto banking account, and how does it work?

With a crypto banking account, you can safely keep, send, receive, change, and arrange both cryptocurrencies and regular money all in one spot. You are always in charge, and you can get to your assets right away when you need them—no delays or problems.

Q. How does oneBanking keep my business secure?

Security is the foundation of oneBanking. We use cutting-edge encryption and partner with top financial companies to protect your finances and data from the start.

Q. Can I really send and receive funds globally with oneBanking?

Absolutely! With oneBanking, you can make or accept payments virtually anywhere in the world, instantly. You never have to worry about location constraints, foreign exchange headaches, or traditional banking delays.

Q. What assets can I manage in my oneBanking account?

Right now, you can manage both major cryptocurrencies and fiat currencies. Soon, you’ll also be able to add stocks, ETFs, and precious metals, letting your business access a complete suite for digital asset management for entrepreneurs.