The future of banking in Europe is going fully digital, and fast. You may witness people checking their balances, splitting bills, or applying for loans immediately from their phones in any café or train station on the continent.

This isn’t simply a fad anymore; it’s how things are now. Digital banking apps have changed the way Europeans handle their money. They make banking faster, smarter, and more personalized. According to Market Data Forecast, in 2024, the digital banking market in Europe was worth USD 8.67 billion. Furthermore, the European market is expected to increase at a rate of 16.90% per year from 2025 to 2033, going from USD 10.14 billion to USD 35.36 billion.

We’ve been keeping an eye on these digital banking trends for 2025 at oneBanking, and it’s evident that the days of traditional banking are coming to an end.

What Is Digital Banking (and Why Is Everyone Talking About It)?

Simply put, digital banking means you can do everything you’d normally do at a bank, but online. Do you want to send money, open a savings account, or even invest? You can accomplish everything from your phone, without having to go to a branch.

No queues. No forms. No “banking hours.” Just 24/7 access, right at your fingertips.

What’s made digital banking in Europe such a big deal is how seamless and stress-free it feels. It’s banking built for how people actually live today: mobile, busy, and always connected.

Why Is Digital Banking the Future?

Here’s the truth: digital banking isn’t just more convenient; it’s a better experience overall.

| Reason | Description |

|---|---|

| It saves time | People don’t want to wait in line or make appointments just to move money around. With apps, everything happens instantly. |

| It’s cost-effective | Digital banks have fewer employees. This implies reduced fees and frequently greater interest rates for customers. |

| It’s more secure | Your money is safer than ever with biometric logins, two-factor authentication, and fraud alerts that happen in real time. |

| It’s smarter | AI-powered programs look at how you spend your money, recommend budgets, and even remind you to save. |

| It’s greener | It is better for the environment to become paperless. |

Experts suggest that the future of banking in Europe isn’t about branches. It’s about better online experiences.

Digital Banking Trends 2025: What’s Shaping the Future

So, what will really change in 2025? A lot. The financial system in Europe is changing more quickly than ever before. These are the most important digital banking trends for 2025 that are changing the game:

1. Challenger banks are leading the charge.

Fintech businesses are raising the bar with their slick, mobile-first designs and no hidden fees. N26, Revolut, and Monzo are some examples.

2. Open Banking is Opening Up New Doors

With EU rules like PSD2, banks must securely share data, letting customers link all their accounts in one place. It’s banking that works with your lifestyle.

3. Embedded Finance is Becoming Everyday

You can now get a loan while shopping online or pay bills through ride-sharing apps. Banking is blending into everything.

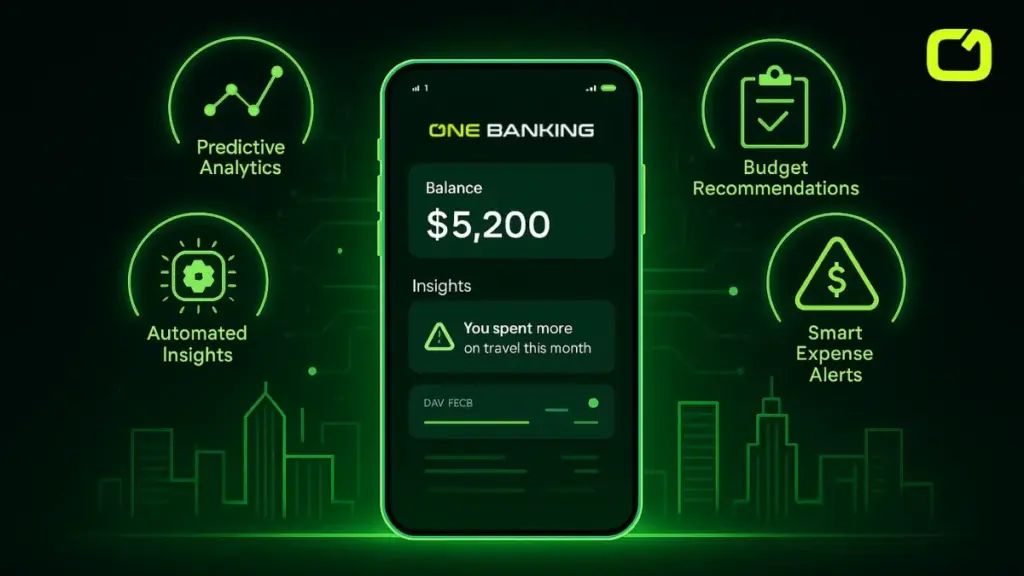

4. AI and Automation are Getting Smarter

Chatbots can now help you manage your money better than ever. They can do so by answering complicated questions, predicting how much you’ll spend, and more.

5. Digital Payments are Everywhere

QR payments, quick transfers, and contactless payments are no longer something of the future; they’re things we do every day.

To put it simply, digital banking in Europe is no longer just a tech test. It’s a revolution that is already changing how millions of people handle their money.

The Most Popular Digital Banks in Europe

If you ask around Europe, you’ll hear a few familiar names when it comes to digital banking.

- People love N26 because it has a simple interface and smart functionality.

- Revolut is useful for people who travel because it has low-fee currency exchange and accounts in more than one currency.

- People in the UK enjoy Monzo because it is transparent and friendly.

These banks are built entirely online with no branches and no paperwork. But they’ve earned massive trust thanks to top-tier security and customer-first design. Traditional banks, noticing the shift, are quickly launching their own digital banking apps to catch up.

Is the Euro Going Digital in 2025?

The digital euro is one of the most important things being spoken about right now when it comes to the future of banking in Europe.

The European Central Bank is now testing what might be a digital version of the euro, which is a central bank digital currency (CBDC). There are already pilot programs and test cases going on, even if it might not be fully rolled out until 2025.

With a digital euro, payments would go through faster and without borders, and it would be easier to connect with current digital banking apps. It could reshape how both individuals and businesses move money across the continent.

The Coolest New Banking Technologies in 2025

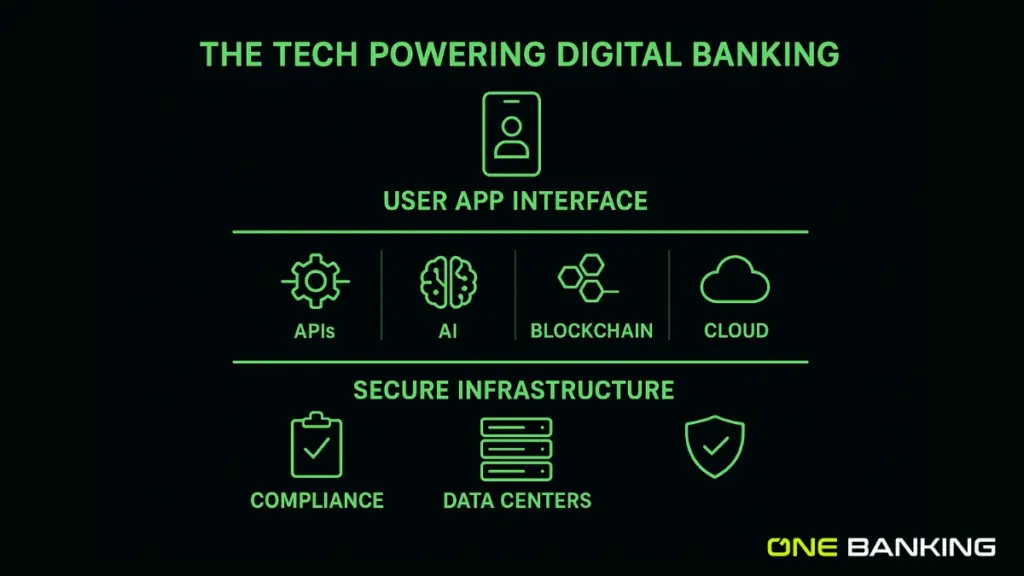

Tech is the backbone of this whole shift. Here’s what’s powering the new era of digital banking in Europe:

| Technology | Description |

|---|---|

| Blockchain | Faster and almost difficult to mess with payments across borders. |

| AI and Machine Learning | Personalizes services, guesses how much you’ll spend, and finds fraud in seconds. |

| APIs (Application Programming Interfaces) | Make it easier for banks and apps to connect. |

| Cloud Computing | Keeps systems fast, adaptable, and reliable. |

| Biometric Authentication | For really secure access, it uses Face ID, fingerprints, and voice recognition. |

Conclusion

The future of banking in Europe is bright, fast, and fully digital. With more people trusting digital banking apps every day, banks are focusing less on buildings and more on better customer experiences.

At oneBanking, we’re proud to be part of this shift, helping users navigate the new world of digital banking in Europe with smarter, simpler, and more secure tools. Banking is changing. The future isn’t coming; it’s already here.

FAQs

Q. What is digital banking?

Digital banking means performing all of your banking online. This includes creating accounts and monitoring loans, utilizing apps on your phone or computer.

Q. Why is digital banking the future?

It fits with how people live now and is faster, safer, and more individualized. It also helps the environment and saves money.

Q. What is the most popular digital bank in Europe?

Revolut, N26, and Monzo are the best right now because they offer easy, mobile-first experiences.

Q. Is the Euro Going Digital in 2025?

The European Central Bank is testing a digital euro, but it may not be available to the public until beyond 2025.

Q. What’s the New Banking Technology in 2025?

The next generation of banking will be shaped by AI, blockchain, cloud computing, and biometric authentication.