Understanding how a SWIFT code works is one of the first things you need to know when sending money across borders, especially if you’re dealing with a SWIFT payment through a bank in Europe or the US. In simple words, a SWIFT Code is like the international address for a bank, and it’s what makes global transfers safe, fast, and accurate. You’ll also hear people call it a BIC Swift Code, but both of these terms point to the exact same thing.

Whether you’re trying to figure out how SWIFT codes in banking actually work or you just want to know how a SWIFT bank uses these codes to route your money, understanding the basics makes international transfers a lot easier. The global trust in the SWIFT Banking System is due to the fact that it helps banks verify where the money is coming from and where it’s going. SWIFT connects over 11,500 financial institutions across more than 200 countries and therefore serves as the backbone of international money transfers.

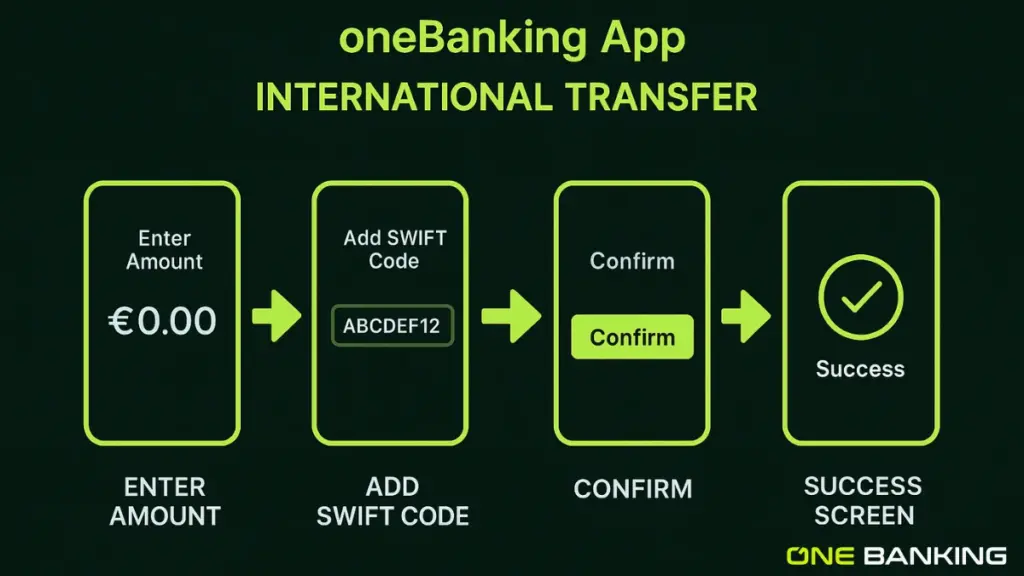

If you’re planning to send money internationally and want something fast and secure, initiating a secure international transfer with the oneBanking app gives you a smooth and simple way to do it without dealing with confusing banking steps.

What Is a SWIFT Code?

A SWIFT Code (also called a BIC Swift Code) is a unique identification code used to identify a specific bank anywhere in the world. You can also consider it like a bank’s international “address.” When you make an overseas transfer, the SWIFT code helps your bank know exactly where to send your money.

A typical SWIFT code looks like this:

ABCDUS33XXX

Each part of this code has a meaning:

- ABCD – Bank code (which bank)

- US – Country code (which country)

- 33 – Location code (which city/region)

- XXX – Branch code (optional)

Every bank that participates in global money transfers has its own unique SWIFT code.

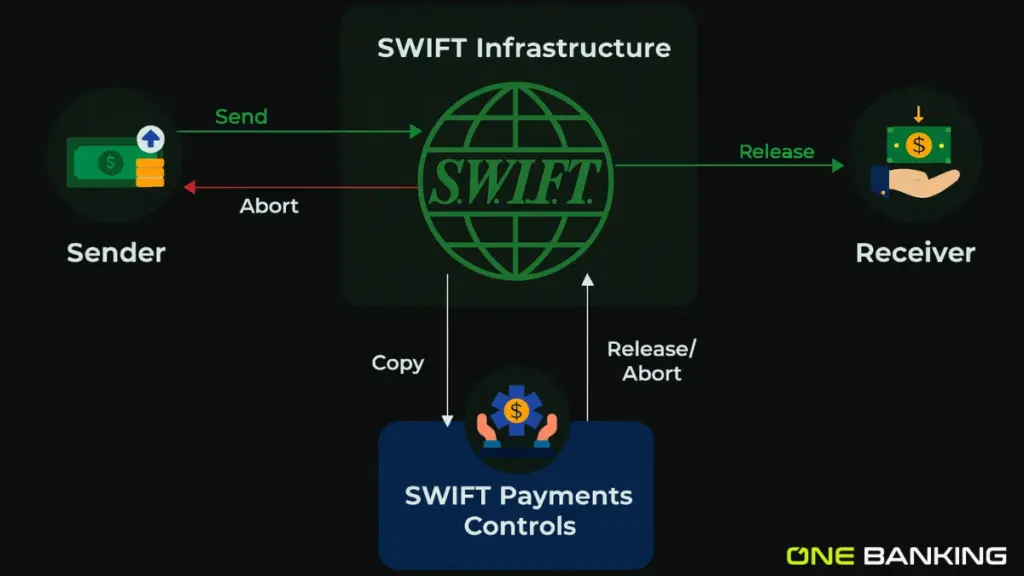

Let’s have also a look at the SWIFT payment system infrastucture in the image diagram given below and get to learn about it core working framework:

Why Banks Use SWIFT Codes for International Payments?

International transfers involve many different banks, networks, currencies, and countries. Without a structured way to identify banks, money could easily get lost or sent to the wrong place.

Banks use SWIFT codes because:

1. They Create a Global Standard

The Swift Banking System connects thousands of banks worldwide. Because of this standard system, every bank understands the same format, which reduces errors and delays.

2. They Improve Security

A SWIFT code ensures the transfer goes only through secure and verified institutions. This reduces the risk of fraud in Swift Banking System transactions.

3. They Help Route Payments Correctly

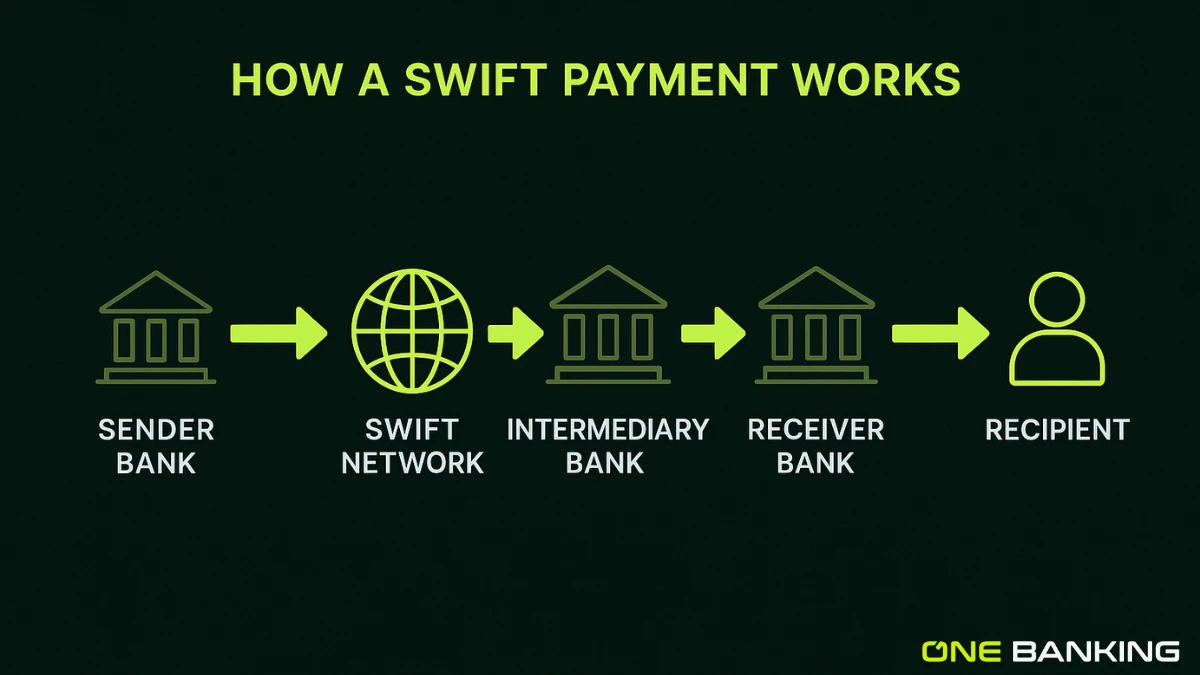

Sometimes your transfer passes through several banks before reaching the final destination. With a SWIFT Code, every bank in the chain knows exactly where to forward the funds.

4. They Speed Up Transfers

When everything is correctly identified, the transfer moves faster. A missing or incorrect SWIFT code can delay a SWIFT payment by days.

5. They Reduce Manual Checks

Without a SWIFT Code, banks would have to manually confirm details, which increases transfer time and errors.

What Information Does a SWIFT Code Provide?

A SWIFT code in banking doesn’t just identify a bank; it sends important details across the global network, such as:

- Bank name

- Bank country

- Branch location

- Verification that the bank is part of the Swift system

When Do You Need a SWIFT Code?

You will need a SWIFT code whenever:

- You’re sending money to another country

- Someone is sending you money internationally

- You’re paying overseas fees (like tuition, rent, or invoices)

- You’re making international business payments

People in the US and Europe especially need to use SWIFT Codes for most international bank transfers, since these regions rely heavily on the SWIFT network.

If you’re planning to send money, the oneBanking app offers a secure and efficient platform for managing your international transfers, especially when you require a bank’s SWIFT code.

How to Find Your Bank’s SWIFT Code

If you’re not sure how to find your bank’s SWIFT Code, here are a few quick and safe ways to check:

1. Check your bank’s official website

Go to the bank’s website and look for sections like “International Payments,” “Wire Transfers,” or “FAQs.” Most banks clearly list their SWIFT/BIC code there.

2. Look at your bank statement

Your monthly bank statements, whether you get them online or on paper, often show the SWIFT code along with your account details.

3. Use your online or mobile banking app

Open your bank’s app and go to the International Transfer or Wire Transfer section. Banks usually include their SWIFT Code there.

4. Call or visit your bank branch

If you do not know a branch-specific code, you can contact your bank either on the phone or in person to obtain that information directly from them. The customer service representatives at your bank can assist you in identifying your SWIFT code.

5. Use a trusted SWIFT directory

Websites like SWIFTRef or official banking directories list verified SWIFT codes for banks around the world.

Knowing how to find the correct SWIFT Code is important, because a small mistake can delay your transfer or even send it to the wrong place. Always double-check the code, especially if the branch code isn’t just “XXX,” to make sure your money reaches the right bank safely.

Is a SWIFT Code the Same as an IBAN?

A very common question is: SWIFT vs IBAN, what’s the difference?

The short answer: They are not the same, and they serve different purposes.

| Feature | SWIFT Code | IBAN |

|---|---|---|

| Purpose | Identifies a specific bank worldwide | Identifies an individual bank account |

| Used For | Routing international transfers between banks | Ensuring money reaches the correct personal or business account |

| Format | 8–11 characters (letters & numbers) | Up to 34 characters (numbers & letters) |

| Example | ABCDUS33XXX | DE89 3704 0044 0532 0130 00 |

| Focus | Bank identification | Account identification |

| Used In | Global transfers (US, Europe, worldwide) | Mostly Europe, Middle East, some other regions |

| Needed for International Transfers? | Yes, almost always | Yes, in countries that use IBAN |

| Part of the Swift Banking System? | Yes | No, but used along with SWIFT |

What Happens If You Enter the Wrong SWIFT Code?

If the SWIFT Code is incorrect:

- Your transfer may fail

- Your bank may hold the payment

- You might be charged extra fees

- The transfer could be delayed for days

This is why double-checking the SWIFT Code for international transfer is extremely important before hitting “send.”

Using apps like oneBanking helps reduce mistakes because the platform guides you through the required details.

Do All Banks Have a SWIFT Code?

No, only banks that participate in the Swift Banking System have one.

However, most major banks in Europe, the US, Asia, and the Middle East are a part of this network since it’s the most widely used international payment system.

If your recipient’s bank doesn’t have a SWIFT code, your bank may use intermediary banks to complete the transaction.

How SWIFT Keeps Global Payments Safe

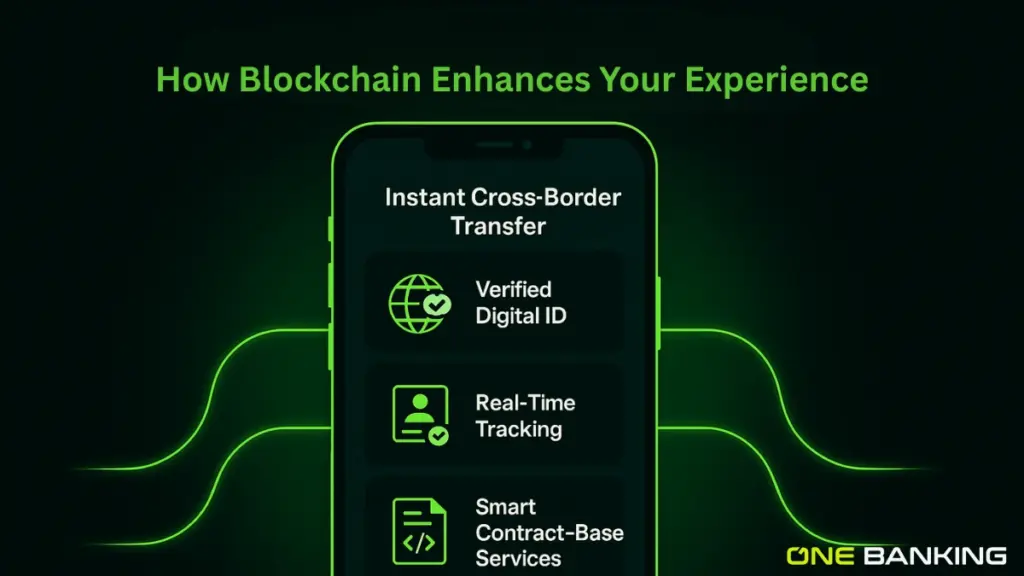

The SWIFT network doesn’t move money directly; it moves information. But the system makes sure all messages sent between banks are:

- Encrypted

- Verified

- Standardized

- Traceable

- Secure

This is why the Swift Payment system is trusted across more than 200 countries.

Why Do SWIFT Codes Matter for People in Europe and the US?

If you’re sending money from the US or Europe:

- Business payments abroad

- Paying suppliers overseas

- Sending money to family

- Handling freelance or remote work payments

- Paying for international services

A SWIFT code is almost always required. That makes understanding it even more important if you’re part of these markets.

Simplifying International Transfers With oneBanking App:

International money transfers can sometimes feel confusing, especially when you’re dealing with different codes, banks, and currencies. But with the right tools, it becomes a lot easier.

If you’re in the US or Europe and want a smooth way to send money overseas, initiating a secure international transfer with the oneBanking app helps you complete every step clearly and safely. The app guides you on what details you need, including the correct BIC Swift Code or SWIFT Code for international transfer, so nothing goes wrong during your transfer.

Conclusion

A SWIFT code is a key part of global banking, helping your money reach the right bank anywhere in the world. Whether you’re comparing SWIFT vs IBAN, understanding the Swift Banking System, or preparing for a Swift Payment, having the right information makes everything smoother and faster.

And when you want a simpler way to handle international transfers, the oneBanking app offers a secure and efficient platform for managing your international transfers without stress or confusion.

FAQ’s

A SWIFT code is a unique ID that tells banks exactly where to send your money internationally. It’s like a bank’s global address.

Banks need it to route your money safely to the right bank in another country. Without it, the transfer can get delayed or even lost.

Most of the time, yes, especially for money going abroad. Some countries use other systems, but SWIFT is the most common.

It makes global transfers safer, faster, and more accurate. It also reduces errors by clearly identifying the bank.

Yes, in most cases you do. The SWIFT code helps your bank send the money to the correct place overseas.

Pingback: SEPA vs XRP: Which Payment System Is Faster and More Efficient?