Let me tell you about something fascinating that’s happening right now in crypto and payments and why I think it matters for all of us in finance.

Recently, I’ve been watching Hyperliquid, a decentralized exchange (DEX) with about $700M in locked assets, make a bold move. They’re proposing their own stablecoin called USDH. On the surface, that might sound like “just another stablecoin,” but it’s actually a pretty big deal.

Here’s why. Hyperliquid already has $5.5B in stablecoins (mostly Circle’s USDC) sitting on it today. Circle quietly collects the interest on those reserves, roughly $200M a year, while Hyperliquid itself and its community get nothing.

USDH flips that model. Whoever issues it has to share the yield back to the ecosystem, paying validators, funding community pools, and even buying back Hyperliquid’s native token, HYPE. If adoption scales, that could mean over $1B a year flowing back into the ecosystem.

That’s huge. The Competition to Issue USDH.

Of course, everyone wants in on this. Right now, multiple teams are lining up to be the issuer of USDH, including:

- Paxos is the regulated player under MiCA in Europe.

- Agora is backed by MoonPay, EtherFi, and LayerZero.

- Ethena Labs and others are circling.

- Even Stripe is rumored to be interested through its new blockchain project, Tempo.

And Circle isn’t stepping aside. Jeremy Allaire, their CEO, basically said, “Don’t believe the hype,” and doubled down with USDC while launching their own chain, Arc.

So what we’re watching is more than just a product launch; it’s the start of a battle for the payment rails of the future.

The Bigger Picture This isn’t just Hyperliquid vs. Circle. The battlefield now includes:

- Stripe (Tempo)

- Circle (Arc)

- Google (GSUL)

- Tether (Plasma)

All are competing with Ethereum, which already processes 60% of all stablecoin volume.

If you zoom out, it’s massive. We’re not just talking about protocol revenue. We’re talking about the potential disruption of Visa, Mastercard, and the foundations of traditional banking. Over the next decade, this could mean trillions of dollars shifting to new rails.

The Geopolitical Twist

And here’s where it gets even more interesting. This “stablecoin war” isn’t just corporate; it’s geopolitical.

The U.S. is sitting on a national debt of over $37 trillion. Recently, a Russian adviser claimed that America might try to move parts of that debt into dollar-backed stablecoins, essentially creating a “crypto cloud” to devalue obligations and hit reset. He compared it to the 1930s Great Depression and the 1970s end of the gold standard.

Now, I’ll be honest: most experts think this is unlikely. There isn’t enough liquidity in Bitcoin or stablecoins to cover that scale, and trying would tank the market. But the point is that stablecoins are now being discussed at the level of national debt strategy.

That tells you just how central they’ve become. This isn’t just tech anymore. It’s about monetary sovereignty, global influence, and who sets the rules of the future financial system.

Why I Care About This at oneBanking

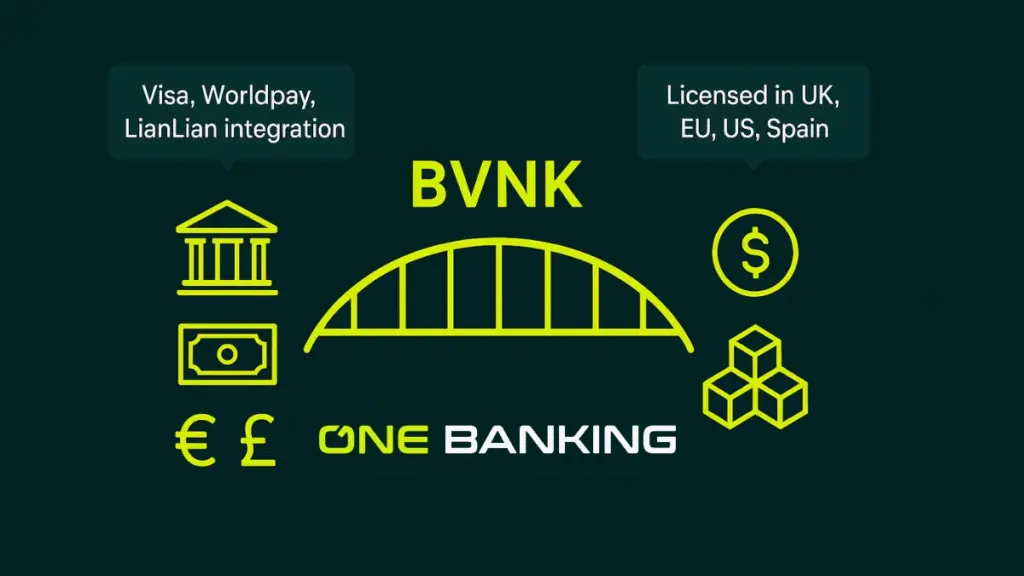

At oneBanking, this is exactly why we’ve partnered with BVNK. For me, it’s about making sure we’re not just watching these shifts from the sidelines; we’re building alongside the most credible players in digital payments.

BVNK is licensed across the UK, EU, US, and Spain. They’re integrated with Visa, Worldpay, and LianLian. They’re building infrastructure that connects fiat, stablecoins, and digital assets seamlessly. And with oneBanking plugged into that, our users get access to a financial system that’s both future-proof and compliant.

So when I look at Hyperliquid’s USDH or debates about whether the U.S. could use stablecoins to manage debt, my takeaway is clear: the rails are shifting fast. And thanks to our partnership, oneBanking customers will be among the first to benefit.

Final Thought

Hyperliquid’s USDH could be a turning point that challenges how stablecoins work and who profits from them. But the bigger story is the global fight for payment rails.

It’s no longer just startups and protocols. Now it’s Stripe, Circle, Google, Tether, and even governments.

For us at oneBanking, the mission hasn’t changed: help people navigate this new world with clarity, trust, and innovation.

The future of money isn’t 10 years away. It’s unfolding right now.