Sending money overseas shouldn’t feel like cracking a secret code, but for most people, that’s exactly what happens the moment they see terms like “SWIFT Code,” “IBAN,” “BIC,” or “sort code.” It’s like a foreign language, and if you get even one character wrong, things can go sideways fast: delays, failed transfers, extra fees… no thanks. And it’s not just you; a global LexisNexis study found that payment failures cost businesses $118.5 billion in a single year, with inaccurate or incomplete banking details being one of the leading causes.

This is exactly why oneBanking exists: to take all that confusion and turn it into clarity. As the world’s first finance app that brings AI, crypto, rewards, and international banking together, oneBanking helps you transfer money across borders with confidence, not stress.

So let’s break things down in a simple way: what SWIFT and IBAN codes actually do, when you need each one, and how oneBanking makes the whole process effortless.

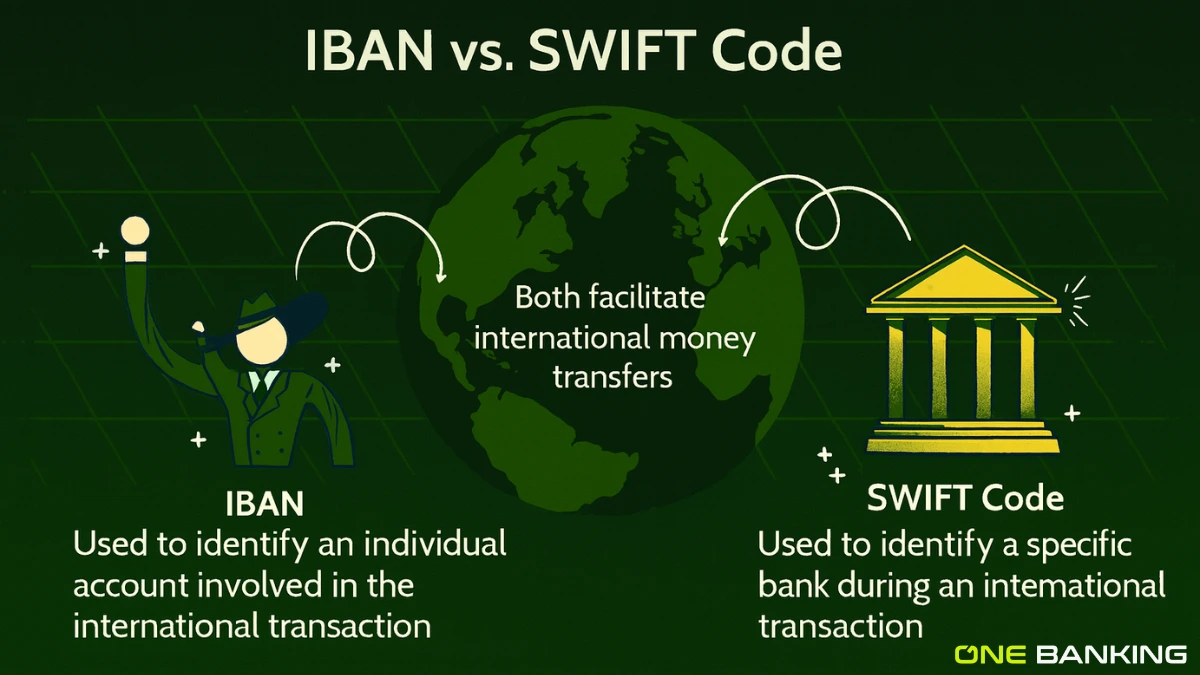

SWIFT vs IBAN: What’s the Real Difference?

The main difference between SWIFT and IBAN is that SWIFT is a code that identifies a specific bank internationally, while IBAN is a number that identifies a specific bank account within a country. SWIFT = bank ID, IBAN = account ID.

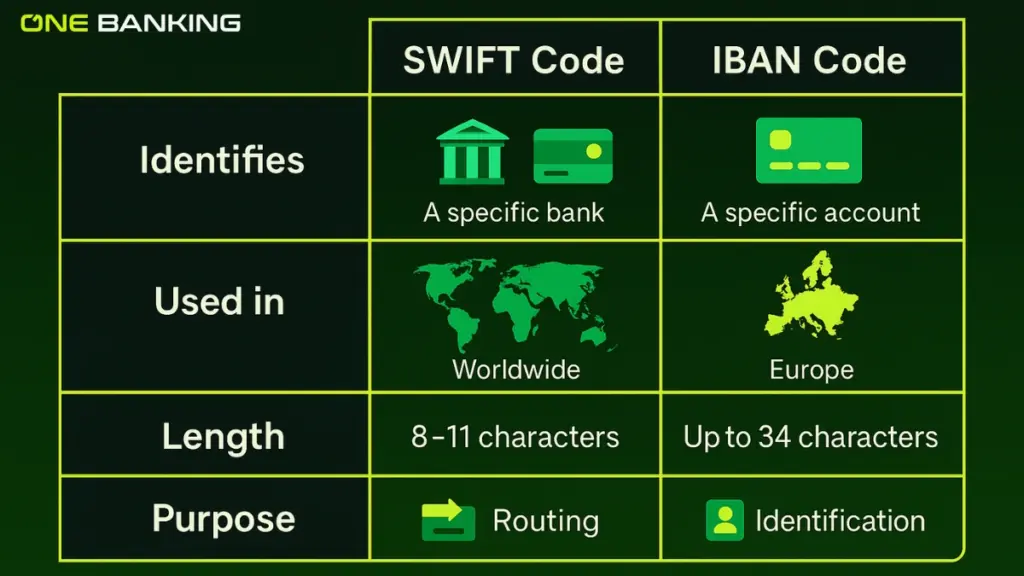

Side-by-Side

| Feature | IBAN Code | SWIFT Code |

|---|---|---|

| Identifies | A specific account | A specific bank |

| Used in | Europe, UK, Middle East | Worldwide |

| Length | Up to 34 characters | 8–11 characters |

| Purpose | Ensures money lands in the right account | Sends money to the right bank |

| Managed by | ISO & local regulators | SWIFT Organization |

In simple terms:

- The IBAN is the full home address.

- The SWIFT Code is the GPS pin to get to the house.

Most international transfers need both. And with oneBanking, the app tells you exactly what you need—no guessing, no frustration.

Which One Is Better?

Here’s the truth: It’s not SWIFT vs IBAN, it’s SWIFT and IBAN.

You use:

- SWIFT – to identify the bank

- IBAN – to identify the account

They’re teammates, not rivals.

When Will You Need a SWIFT Code?

- Sending money to the U.S. (you’ll need the Bank’s SWIFT Code for the transfer)

- Sending to Canada, Asia, Australia, or Latin America

- Receiving money from overseas

When Will You Need an IBAN?

- Sending money to Europe, the UK, or the Middle East

- Receiving money from European countries

- Making SEPA transfers

With oneBanking, you simply choose where you’re sending money, and the app automatically determines whether you need SWIFT, IBAN, or both.

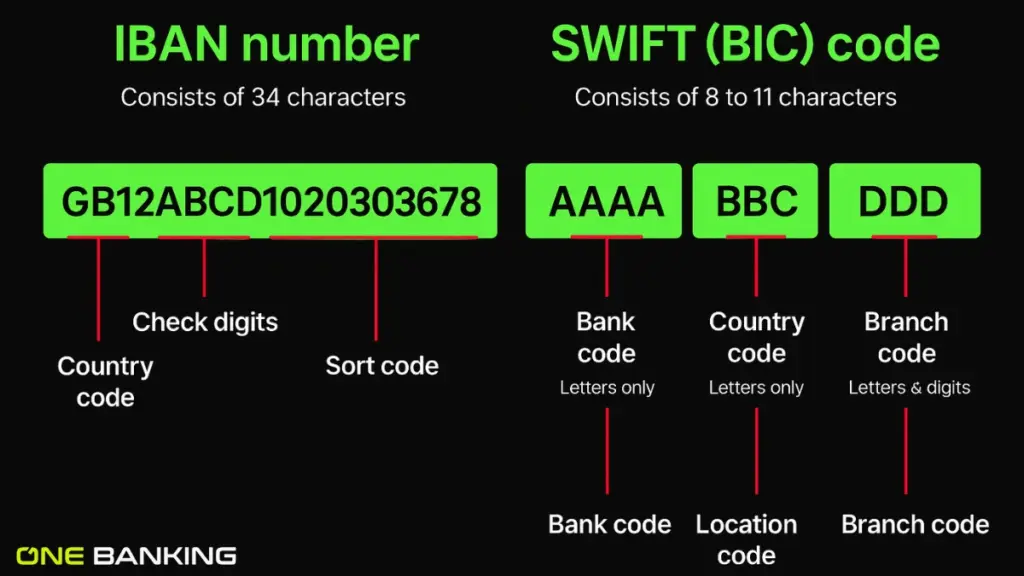

Examples of SWIFT and IBAN Codes:

SWIFT Examples

- CHASUS33 – JPMorgan Chase (USA)

- DEUTDEFF – Deutsche Bank (Germany)

- BARCGB22 – Barclays (UK)

IBAN Examples

- GB13BUKB60161331926811 – Barclays UK

- DE89370400440532013000 – Germany

- FR7630006000011234567890189 – France

oneBanking validates codes in real time to help you avoid transfer mishaps.

Which Is Faster: SWIFT or IBAN?

The speed depends more on the transfer network than the code itself.

- IBAN transfers within Europe (especially SEPA transfers) can be extremely fast, sometimes taking minutes.

- SWIFT transfers can be slower because they might pass through intermediary banks along the way.

oneBanking partners with fast, globally trusted liquidity providers like BVNK, OKX, Kraken, and FinchTrade to give you some of the quickest transfer speeds available.

Are IBAN and SWIFT Enough on Their Own?

For most countries, yes, that’s all you need. But some countries require extra info:

- USA: Routing number

- UK: Sort code

- Mexico: CLABE

- India: IFSC

- Australia: BSB

oneBanking automatically prompts you if additional details are needed, so you never miss anything.

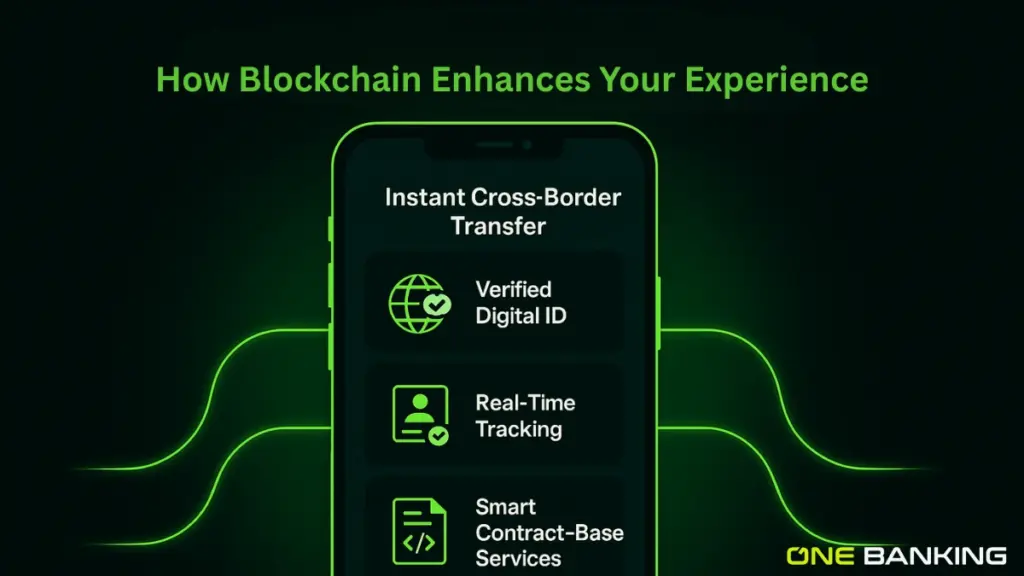

How oneBanking Makes International Transfers Easy?

Here’s where the magic happens.

AI-Powered Guidance

The app helps you verify codes, avoid mistakes, and send money with confidence.

Multi-Currency Wallets

Manage fiat and crypto in one place, with no juggling of apps or accounts.

Rewards on Every Action

Transfers, payments, crypto trades—everything earns points.

Backed by Trusted Partners

Your money moves through a secure network including Visa, Coinbase, OKX, Kraken, and others.

EU IBAN with Visa

Giving you the flexibility and access traditional banks struggle to match.

Conclusion

SWIFT codes and IBANs may look complicated, but they serve a simple purpose:

- SWIFT tells the system where the bank is.

- IBAN tells it exactly which account should receive the money.

Most banks leave you to figure this out on your own. oneBanking makes it automatic, intelligent, and effortless.

If you want money transfers that feel modern (not like banking from 1998), oneBanking is built for you.

FAQs on SWIFT vs IBAN codes:

An international account number is used to identify a specific bank account.

It includes a country code, check digits, and up to 30 alphanumeric characters.

Open the oneBanking app—it’s right on your dashboard.

IBAN transfers inside Europe can be faster, but timing depends on the network.

Usually yes, but some countries need extra details. oneBanking tells you exactly what’s needed.

With AI tools, crypto, an EU IBAN, and global partners, oneBanking offers one of the most advanced international transfer experiences.

IBAN – exact account

SWIFT – the bank

SWIFT: CHASUS33, BARCGB22 IBAN: GB13BUKB60161331926811

Use SWIFT for the bank and IBAN for the account, especially in European transfers.