There are many different options for sending money internationally, but without knowing how to go about doing so, the process can be quite difficult and time-consuming as well as expensive. As a result, many people and companies are comparing the advantages and disadvantages of using SEPA vs XRP for these types of transactions. Both have their strengths, but they work very differently depending on your needs.

If you’re in the US or Europe and want a simple way to send money overseas, the oneBanking app makes the process easy and secure. With the app, you can choose the best method for your transfer, whether it’s a SEPA payment for euros in Europe or an XRP transfer for fast global payments without dealing with complicated banking processes.

What is XRP?

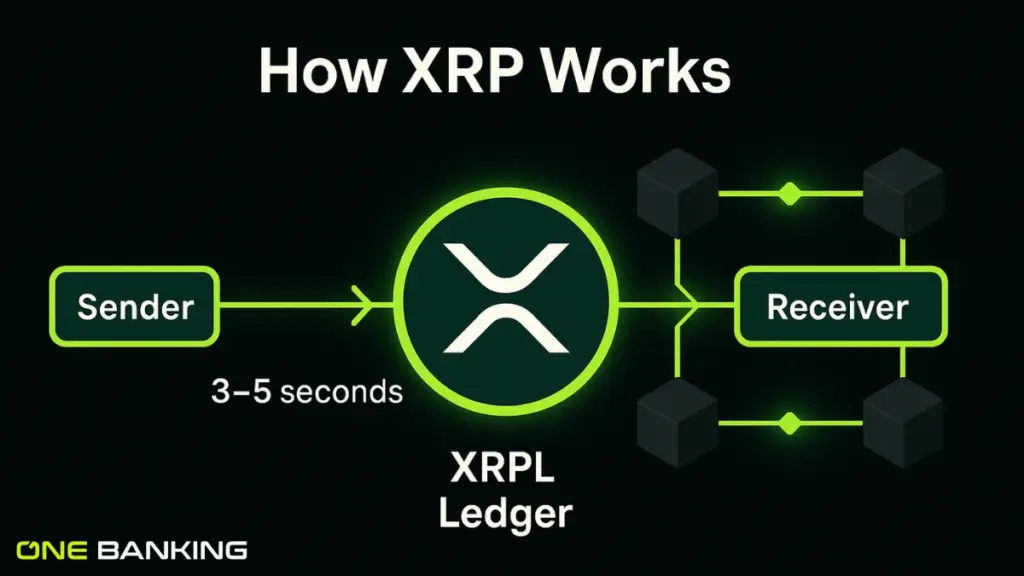

XRP is a cryptocurrency that runs on the XRP Ledger. It’s a digital currency built for fast as well as secure transfers. All the transactions are verified using blockchain technology, which makes it nearly impossible to fake or double-spend XRP.

Jed McCaleb, Arthur Britto, and David Schwartz created the XRP Ledger during the period of 2011-2012. Initially, there were 100 billion XRP tokens created. Later, 80 billion XRP were given to Ripple (then OpenCoin Inc.) to help develop the XRP network and encourage adoption.

How XRP Got Its Name

The XRP Ledger was first called “Ripple” because it allowed payments to ripple through multiple currencies. The digital asset itself was called XRP, which is short for “ripple credits,” and with the X prefix following the ISO standard for non-national currencies. Eventually, the company shortened its name to Ripple, while XRP became the official name of the cryptocurrency.

XRP is now a registered trademark of the XRPL Foundation in the U.S. and other countries, making it a recognized and trusted digital currency.

What is SEPA?

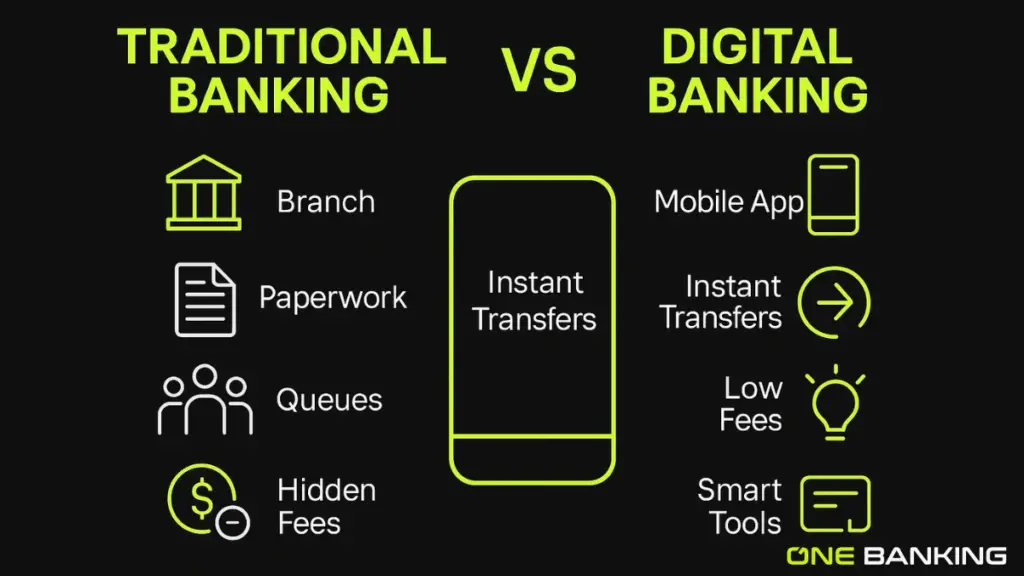

SEPA stands for the Single Euro Payments Area. It’s an EU initiative to facilitate the transfer of euros throughout Europe and make it easier and more standardized. With SEPA, whether you’re sending money within your own country or across borders in the SEPA zone, the process is the same.

SEPA includes all EU member states and some non-EU countries like Norway, Switzerland, and parts of the UK. For businesses and individuals, this means faster, cheaper, and more predictable euro transfers.

Why SEPA Matters

For companies expanding in Europe, SEPA makes euro transfers as simple as domestic ones. There’s no need to open multiple bank accounts in different countries, and payments use standardized codes like IBAN and BIC.

For consumers and small enterprises, SEPA offers clear costs, dependable processing, and usually completes transactions within one business day. It is particularly helpful for e-commerce, supplier payments, and payroll. SEPA also helps banks and authorities monitor transactions for compliance and financial crime prevention.

SEPA vs XRP: Speed and Efficiency

So, how do SEPA and XRP compare?

- Speed: SEPA standard transfers usually take one business day, while SEPA Instant is usually faster but depends upon bank hours. XRP transfers settle in seconds, anywhere in the world, regardless of country and banking hours.

- Cost: The cost of SEPA transfers within Europe and the SEPA zone is generally low but can rise for transfers outside of it. XRP transaction fees are very low, even for cross-border payments.

- Regulation: SEPA is highly regulated and is accepted extensively in Europe. XRP operates in the cryptocurrency space, and the laws differ depending on the country.

- Flexibility: XRP can send money around the world and in other currencies. SEPA is restricted to the euro and to the SEPA region.

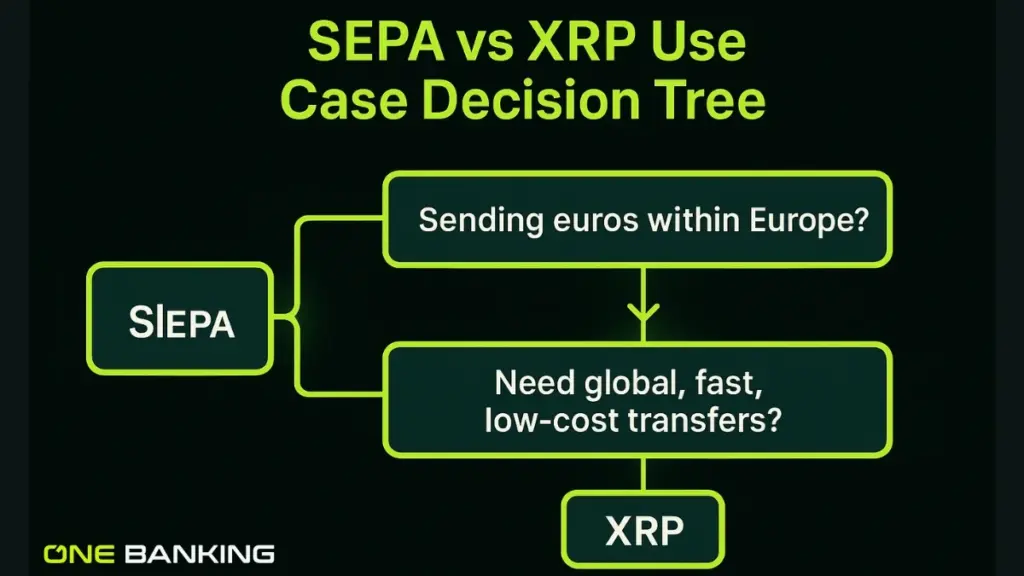

In short, SEPA is ideal for regulated euro payments in Europe, while XRP is best for fast, low-cost, global transfers.

How oneBanking App Makes International Transfers Easy?

If you’re in the US or Europe and want a smooth way to send money overseas, initiating a secure international transfer with the oneBanking app makes it simple and safe. The app guides you through every step, including entering the correct BIC or SWIFT code, so your transfer goes through without any mistakes.

And when you want a simpler way to manage international transfers, the oneBanking app offers a secure and efficient platform to handle payments without stress or confusion. Whether you’re using SEPA or XRP, the oneBanking app helps make your money movement faster, clearer, and safer.

Which One Should You Choose?

- Choose SEPA if you mainly send euros within Europe and want fully regulated, predictable transfers.

- Choose XRP if speed, low fees, and global reach are your priorities and you’re comfortable with cryptocurrency.

Many people use both depending on their needs. With one banking app, you can take advantage of the benefits of each system while keeping transfers simple and stress-free.

Conclusion

When comparing SEPA and XRP, each has its strengths. SEPA is trusted, regulated, and ideal for euro transfers within Europe. XRP is fast, flexible, and low-cost for cross-border payments anywhere in the world.

With the oneBanking app, sending money internationally becomes easier and safer, whether you’re using SEPA, XRP, or both. It guides you step by step, ensuring your transfers are secure and completely stress-free. Understanding SEPA vs XRP helps you pick the right option, and using one banking app makes the process smooth and efficient.

The SEPA (Single Euro Payments Area) payment system in Europe makes sending euros between participating countries fast as well as secure.

SEPA works in most EU countries, including all EU member states, EEA countries, and a few others. Before transferring money, make sure it’s available where you are and check with your bank or payment provider.

You can use Ripple (XRP) to buy lots of things online, like clothes, gadgets, flights, hotels, and more. Many businesses now accept XRP, and you can also trade it for other cryptocurrencies or use it in decentralized finance (DeFi) apps.