Banking has changed faster in the past few years than in the previous decade. The global shock of COVID-19 pushed customers toward safer, contactless options, and that shift never reversed. Modern consumers now expect speed, convenience, and control from every financial service they use. At the same time, FinTech startups have stepped into the market with smarter tools and fresh ideas, increasing competition and raising the bar for what banking should feel like.

These forces have reshaped digital transformation in banking and exposed the rigidity of traditional systems. While branches continue to close worldwide, digital activity keeps climbing. Lloyds Bank, for example, announced plans to shut 60 UK branches after reporting a 12 percent rise in online banking use and a 27 percent jump in mobile app activity in just two years. Customers are choosing digital first, and traditional banks are racing to keep up.

But digital transformation is not only about new technology. It requires a shift in mindset, better digital literacy, and modern tools that match how people now manage their money. That is why more banks and individuals are turning to digital platforms. If you are ready to move your finances into a faster, clearer system, the oneBanking App offers a simple path forward.

This guide walks you through the process step by step so you can switch smoothly and manage your money with confidence.

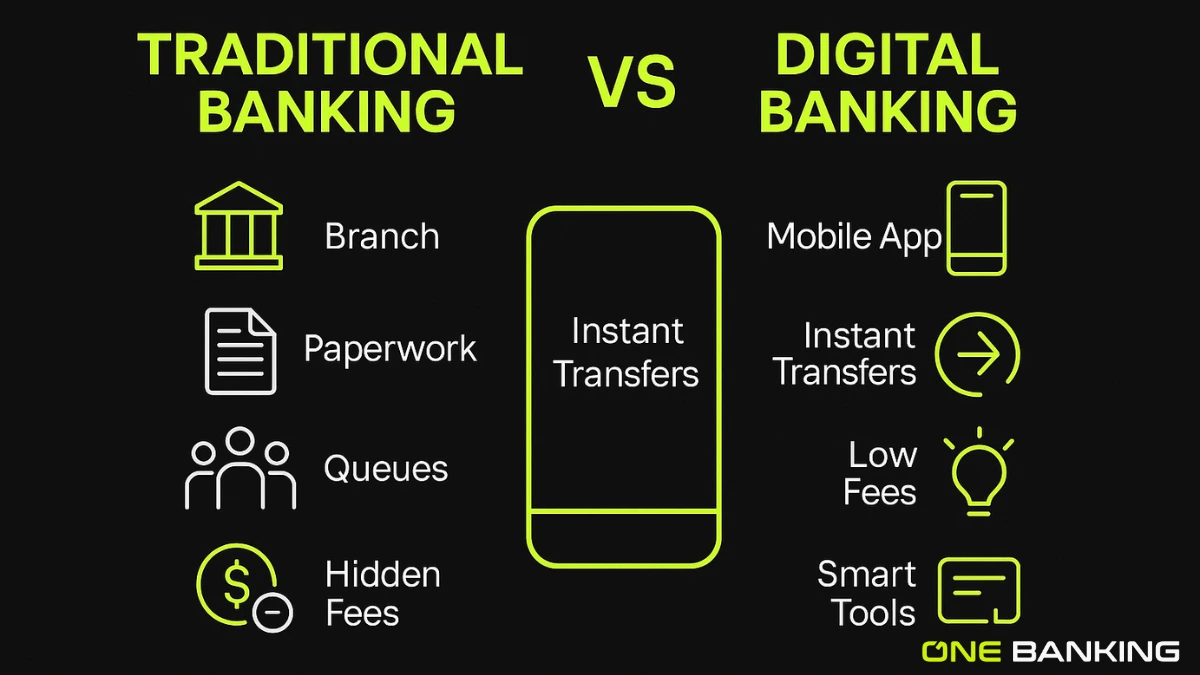

Why People Are Leaving Traditional Banking?

Traditional banks still play a role, but they often rely on older systems, slow processes, and fees that no longer make sense. Digital banks worked around those problems by building everything for speed and flexibility.

Here is why more people are choosing digital banking:

1. Fewer fees

Most digital banks cut out monthly charges and keep transfer costs low.

2. Real-time access

You can check your balance, send money, pay bills, or freeze your card instantly.

3. Smart tools

Digital banking apps offer budgeting tools, spending alerts, and automated savings that help you understand your money.

4. Faster support

You get help through in-app chat instead of waiting at a branch.

5. Strong security

Biometric login, encryption, and instant fraud alerts make digital banking more secure than many expect.

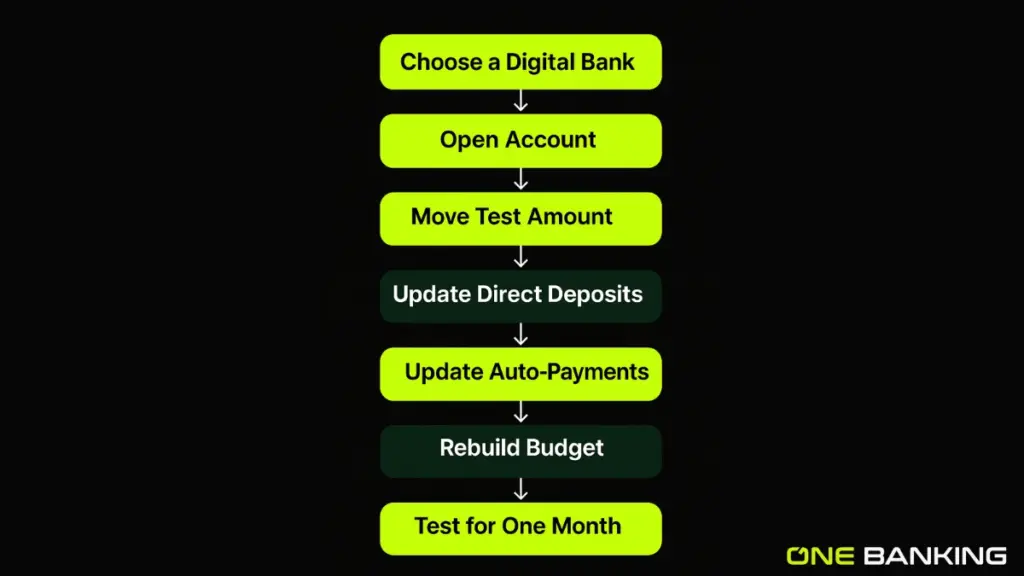

Step-by-Step Guide to Moving Your Finances:

Switching to a digital bank is simple when you follow a clear order.

Step 1: Choose the Right Digital Bank

Look for a provider that matches your needs. Compare:

- Security features

- App design and ease of use

- Fee structure

- Customer support quality

- Extra tools such as savings automation, sub-accounts, or early direct deposit

The oneBanking app makes this process easy with a clean interface, strong security, and flexible budgeting tools.

Step 2: Open Your New Digital Account

You usually need:

- A government ID

- Proof of address

- Your phone and email

Most signups take ten minutes. Digital banking apps use ID scanning and face verification to keep the process safe and fast.

Step 3: Move a Small Test Amount

Transfer a small amount of money into your new account. This lets you test transfer speed, explore the app, and make sure everything works the way you want. When you are comfortable, transfer the rest.

Step 4: Update Your Direct Deposits

Log in to your employer’s payroll system or contact HR. Enter your new account and routing number. Do the same for:

- Freelance income

- Marketplace payouts

- Government benefits

This ensures you do not miss any deposits during the transition.

Step 5: Move Your Auto Payments

List every recurring payment tied to your old bank:

- Streaming services

- Utilities

- Phone bills

- Insurance

- Loan payments

- Subscriptions

Update each one with your new digital banking details. This step prevents late payments and confusion once you close your old account.

Step 6: Rebuild Your Budget in Your New App

Digital banking offers better money tracking than most traditional banks. Use your new app to set:

- Spending categories

- Alerts for large purchases

- Automated savings rules

- Round up savings

- Goal-based pockets or folders

These features give you more control and insight into your money.

Step 7: Run Everything Through Your New Account for One Month

Give yourself time to adjust. Watch:

- Transfer speed

- App reliability

- Customer support response times

- How well the tools match your routine

If everything runs smoothly, you can finalize the switch.

Step 8: Close Your Traditional Bank Account

Before closing, confirm that:

- All deposits now go to your new digital bank

- All auto payments run successfully

- All checks have cleared

- No pending transactions remain

Once clear, you can close the account with your traditional bank.

Is Digital Banking Safer?

Many people worry about safety, but digital banks use advanced security systems built into the app. This includes:

- Biometric logins

- Encrypted data

- Instant fraud alerts

- Card freeze with one tap

Traditional banks rely on older systems and slower updates. Digital banking often delivers stronger, faster protection as part of standard service.

What to Consider Before Switching

Before you fully commit to digital banking, think through a few factors:

- Cash deposits

If you deposit cash often, check whether your digital bank partners with ATM networks or retail locations.

- Branch access

If you prefer talking to someone in person, consider a hybrid bank. Some digital banks are fully online.

- Travel needs

If you travel, check fees for currency conversion and ATM withdrawals abroad.

- Joint accounts

If you share finances, confirm your digital bank supports joint accounts or shared budgeting tools.

- Linked loans

If your old bank controls your loan payments, update your autopay info so nothing gets missed.

Benefits of Digital Banking

Once you switch, the advantages become clear.

- Speed: Everything updates instantly.

- Transparency: Clear fees. Clear statements. No surprises.

- Control: Freeze cards, create savings pockets, track spending, and move money in seconds.

- Convenience: No waiting rooms. No lines. No fixed hours.

- Continuous innovation: Digital banks release updates and new features often.

This is the result of digital transformation in banking. It puts the power back in the hands of the customer.

Why You Should Switch Now

People move from traditional banking to digital banking because it saves time, lowers costs, and gives real control over their finances. Digital banking is built for the way people live today.

The oneBanking app gives you the tools to manage your money with clarity and confidence. If you are ready to work faster and smarter, now is the perfect moment to switch.

Conclusion

Switching from traditional banking to digital banking is one of the simplest ways to improve your financial routine. It gives you more clarity, more speed, and more control. As digital transformation reshapes the financial world, customers benefit from smarter tools and better experiences. The oneBanking app brings these advantages together in one clean platform that helps you manage money with confidence. If you want to move away from outdated systems and step into a faster, simpler future, a digital banking app is the right place to start.

FAQs

1. How are digital banks replacing traditional banks?

Digital banks offer faster, low-cost, app-based services that remove the need for physical branches. Their convenience, automation, and 24/7 access are driving the shift away from traditional banking.

2. Step-by-step guide to transfer accounts to a digital bank

Choose a trusted digital bank, complete online KYC, and open your new account. Then update your autopay, salaries, and linked services before closing your old account if needed.

3. Is digital banking safer than traditional banking?

Both use strong security, but digital banks often add extra layers like biometrics and real-time monitoring. Safety largely depends on the bank’s tech and the user’s cybersecurity habits.

4. What to consider before switching to a digital bank?

Check fees, security features, customer support, and ease of use. Also review interest rates, ATM access, and how well the app fits your lifestyle.

It saves time with instant transactions and eliminates branch visits. You also get smarter tools like analytics, budgeting, and automated payments.

24/7 access, faster payments, and lower fees compared to traditional banks. Plus, digital banks offer better user experience and smarter financial insights.

Banks are adopting AI, automation, cloud, and data analytics to improve speed and efficiency. This shift enables personalized services, stronger security, and more innovative financial products.

Simon Streiner

Really interesting! Thank you!