Stablecoins are rapidly transforming how money moves across borders. As of mid-2025, the total supply of global stablecoins has exceeded US$250 billion, while monthly on-chain transactions and transfers have surged to trillions of dollars, underscoring their growing use in payments and transfers.

At the same time, the top two stablecoins, Tether (USDT) and USD Coin (USDC), continue to dominate the market, together capturing around 85–90%.

Against that backdrop, the oneBanking app is helping users understand how stablecoins actually work and why they are shaping the next chapter of international transfers.

Stablecoins stand out because they offer the stability of traditional money and the speed of blockchain. Their value stays close to a fixed currency, usually the US dollar, which makes them useful for everyday payments, not speculation. For anyone who needs to send, receive, or manage money internationally, stablecoins offer a simple and reliable solution.

This blog explains how stablecoins are changing global payments without jargon, without fluff, and with a focus on real-world usage.

What Are Stablecoins?

Stablecoins are digital currencies that are designed to hold a steady value. Most stablecoins are tied to the US dollar at a 1:1 ratio, meaning one stablecoin equals one dollar. Because of this fixed value, stablecoins avoid the extreme price moves you see in other cryptocurrencies.

People use stablecoins when they want fast, affordable, and dependable transfers. Whether a business pays overseas vendors or a worker sends money home, stablecoins ensure the amount received is the same as the amount sent.

They bring the predictability of cash and the convenience of digital money together.

How Do Stablecoins Stay Stable?

Stablecoins remain steady because of the mechanisms behind them. The three most common types are

1. Fiat-Backed Stablecoins

These are supported by real dollars held in reserve.

Examples: USDC, USDT.

For every token issued, the issuer keeps an equivalent dollar in a bank or in short-term treasuries.

2. Crypto-Backed Stablecoins

These use cryptocurrency reserves as collateral.

Example: DAI.

To handle price fluctuations, they are backed by more collateral than the value of the stablecoin.

3. Algorithmic Stablecoins

These adjust supply through programmed rules rather than collateral. They are less trusted and more experimental.

For international payments, fiat-backed stablecoins remain the preferred option because they are easier to verify and widely supported across payment platforms.

Why Are Stablecoins Gaining Popularity in Cross-Border Payments?

International payments are still slower and more expensive than they need to be. Transfers often involve several intermediaries, unpredictable FX rates, and multi-day settlement cycles. Stablecoins provide a cleaner, faster alternative.

Here’s why stablecoins stand out:

Faster Transfers

Stablecoin payments clear in minutes, reducing the waiting time that usually comes with wire transfers or traditional remittances.

Lower Transaction Costs

Sending stablecoins often costs far less than bank transfers or money transfer services. This helps both individuals and businesses keep more of what they earn.

Consistent Value

Since stablecoins maintain their value, people do not lose money due to sudden currency fluctuations.

Global Reach

Stablecoins move freely across borders without needing a local bank account. This makes them valuable in regions with limited banking access or strict transfer restrictions.

Real-Time Visibility

Every stablecoin transaction is recorded on the blockchain. Payments can be tracked instantly, reducing confusion or delays.

This mix of speed, savings, and transparency is why stablecoins are becoming essential for international transactions.

How Stablecoins Benefit Different User Groups?

The usefulness of stablecoins goes far beyond crypto investors. Here’s who benefits the most:

1. Freelancers and Remote Workers

People working for global companies often face slow payments and poor FX rates. Stablecoins allow them to get paid in minutes, then convert the funds locally at a better rate.

2. Businesses and Startups

Companies paying overseas suppliers or contractors can settle invoices quickly, helping maintain steady cash flow and removing the risk of delays.

3. Individuals Sending Money Home

For families relying on remittances, stablecoins offer a high-speed, low-fee alternative to traditional money transfer agents.

4. E-commerce Sellers

Online sellers dealing with buyers worldwide can accept stablecoins to get instant payments and avoid chargeback issues.

5. Fintech and Payment Platforms

Apps and financial services integrate stablecoins to offer faster withdrawals and deposits. The oneBanking app is part of this new wave of practical and simple stablecoin use.

Stablecoins serve real needs and solve long-standing payment problems.

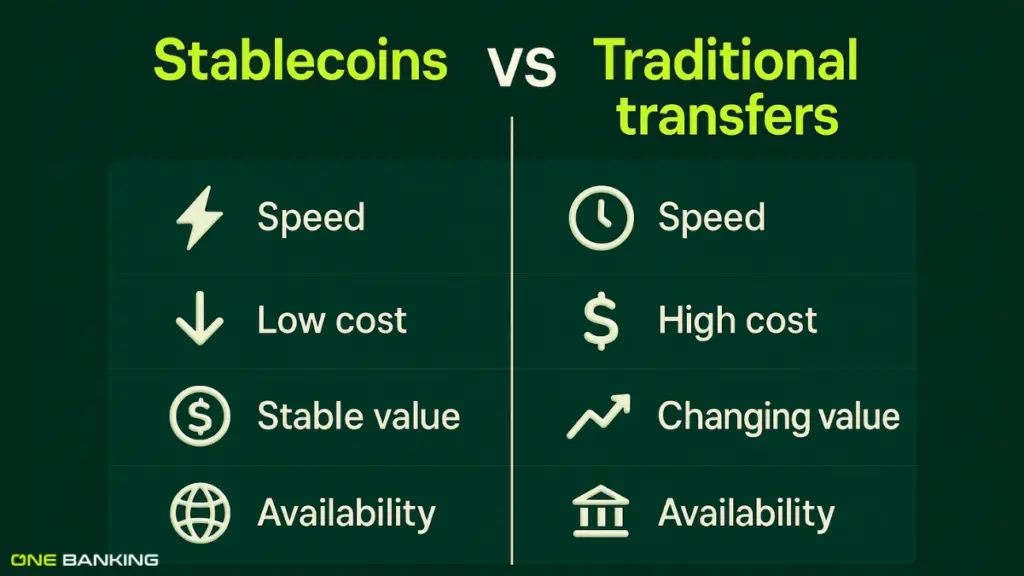

Stablecoins vs. Traditional International Transfers

Here’s a clear comparison of stablecoins and conventional cross-border payments:

| Feature | Stablecoins | Traditional International Transfers |

|---|---|---|

| Settlement Time | Minutes | 2–5 days |

| Fees | Low | Often high |

| Availability | 24/7 | Limited by banking hours |

| Tracking | Transparent | Not always clear |

| FX Risk | Very low | Can be significant |

| Accessibility | Global | Restricted in many regions |

Stablecoins don’t replace banks entirely, but they fix major issues that users have struggled with for years.

Why Stablecoins Work Well for International Payments?

Stablecoins fit perfectly into global payment needs because they offer:

1. Speed

Money moves instantly, helping people and businesses stay financially active without delays.

2. Predictable Value

Since stablecoins are tied to a fixed currency, users avoid sudden losses.

3. Simple Conversion

Stablecoins can be exchanged for local currencies through exchanges or payment apps.

4. Reduced Middlemen

Fewer intermediaries mean fewer fees and fewer chances for errors.

5. Easy Integration

Businesses can use stablecoins alongside their existing payment systems without full infrastructure changes.

These qualities make stablecoins increasingly relevant for both personal and business-related international payments.

Risks to Keep in Mind

Stablecoins offer many benefits, but users should stay aware of a few points:

Issuer Reliability

It’s essential to select stablecoins with robust audits and transparent proof of reserves.

Network Fees

Different blockchains have different transaction costs. Some networks are more cost-friendly than others.

Storage Safety

Users should store stablecoins in secure wallets and avoid unknown platforms.

Regulatory Updates

Rules around stablecoins are still developing, so users should stick to compliant platforms like the oneBanking app.

Used wisely, stablecoins remain one of the most practical digital assets for payments.

The Future of Stablecoins in Global Payments

Stablecoins are expected to play a central role in the next phase of financial services. As more companies, governments, and payment providers explore blockchain-based settlements, stablecoins will support:

- Faster international payroll

- Low-cost remittances

- Supplier payouts

- Merchant settlements

- Fintech innovations

- Cross-border e-commerce

Stablecoins are no longer experimental. They are being used daily by millions, and their adoption continues to rise. One of the strongest use cases is international payments, exactly the area where users face the highest friction.

The oneBanking app continues to help people understand stablecoins and use them confidently for safer, faster, and more affordable global transfers.

Conclusion

Stablecoins bring speed, reliability, and cost savings to international payments. They remove common barriers like high fees, delays, and unpredictable exchange rates. As people and businesses look for simpler ways to move money globally, stablecoins are becoming a practical and trustworthy solution.

With one banking app supporting users every step of the way, stablecoins open a smoother and more accessible path for global payments.

Stablecoins are digital currencies designed to maintain a fixed value, usually tied to the US dollar. They offer the speed of crypto transactions without the price swings seen in other cryptocurrencies.

The most widely used stablecoins include

USDT (Tether)

USDC (USD Coin)

DAI

BUSD

TUSD (TrueUSD)

These stablecoins are commonly used for payments, transfers, and trading because of their stable value.

No. Bitcoin is not a stablecoin. Its price changes often based on market demand. Stablecoins, on the other hand, are designed to stay close to a fixed value, usually $1.

You can buy stablecoins through:

Crypto exchanges

Payment apps that support stablecoins

Digital wallets that offer direct purchase options

With platforms like the oneBanking app, you can also use stablecoins for simple, fast international payments.

Most traditional banks do not issue stablecoins yet. However, some financial institutions are testing tokenized versions of cash, and many fintech apps support stablecoin transfers. Platforms like oneBanking App make it easier for users to access and use stablecoins for daily transactions.