Sending money abroad shouldn’t feel like you’re losing half of it to fees. That’s where blockchain banking steps in: a smarter, faster, and cheaper way to move money across borders.

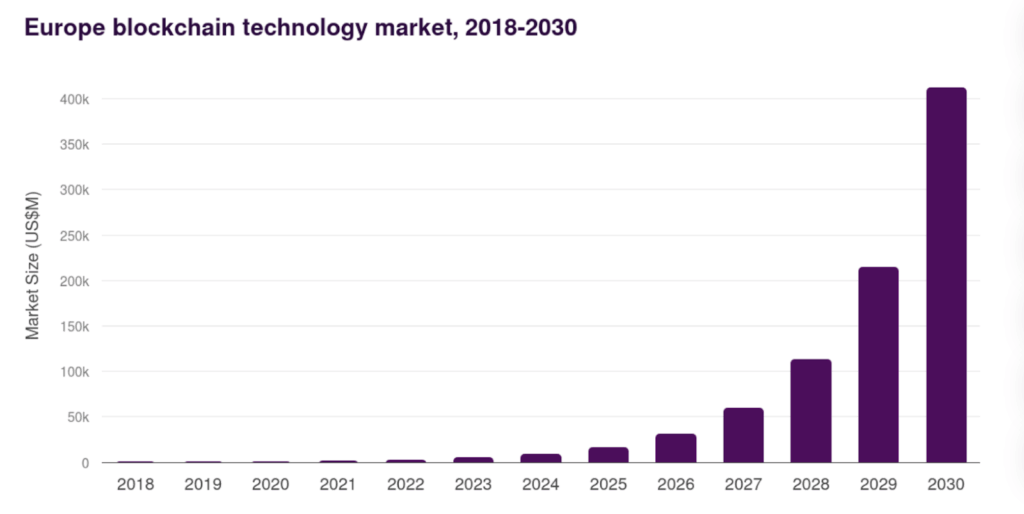

According to Grand View Horizon, by 2030, the European blockchain technology market is predicted to make $412,282.2 million. From 2025 to 2030, the Europe blockchain technology industry is estimated to develop at a pace of 89.5% per year.

At oneBanking, we’re using blockchain banking technology to make global transfers simple and affordable. Whether you’re sending money to family, paying freelancers, or running a global business, our Blockchain Banking System ensures your money travels instantly—without the usual hidden costs.

source: Grand View Horizon

The Old Way: Slow, Expensive, and Complicated

If you’ve ever made an international bank transfer, you know the pain. You send $1,000, and by the time it lands, fees and exchange rates have eaten into it. Traditional banks use a network of intermediaries—each taking a small cut and adding extra processing time.

It’s not uncommon for international transfers to take several days, and the sender often has no idea where the money is during that time. That’s exactly what blockchain in banking aims to change.

The New Way: Blockchain Banking

So, what’s different about blockchain banking? Instead of routing your money through multiple banks, blockchain connects sender and receiver directly on a secure, digital network.

Here’s how it changes the game:

1. No Middlemen, No Extra Fees

Traditional transfers pass through several financial institutions. With blockchain, it’s a direct, peer-to-peer transaction. Fewer hands touching your money means fewer fees.

2. Instant Transfers

Forget waiting days for a payment to clear. Thanks to blockchain banking technology, transfers can settle in minutes—even seconds.

3. Transparent and Traceable

Every transaction on a blockchain is visible and verifiable. You always know where your money is—no guessing, no “processing” delays.

4. Global Access

With crypto and digital currencies, you can send money anywhere, anytime—no business hours or banking holidays.

That’s exactly how oneBanking is using blockchain to make international banking fair, fast, and affordable.

Crypto Banking: The Smart Future of Money

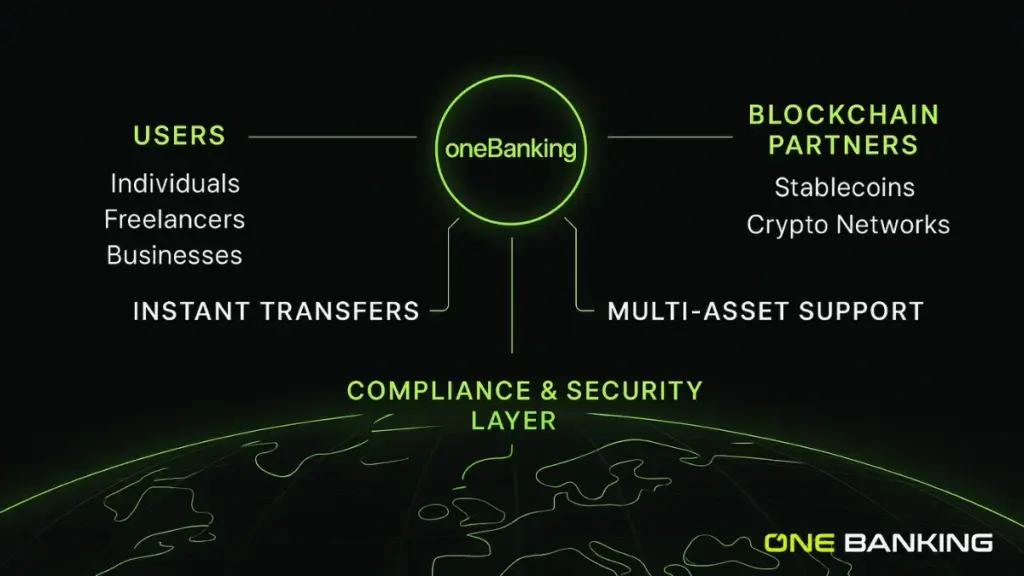

Crypto banking is the next evolution in finance. It combines traditional banking reliability with the speed and flexibility of blockchain.

At oneBanking, you can manage both fiat and crypto seamlessly, send payments, hold digital assets, and convert currencies instantly.

Our users love it because:

- Transfers are instant and borderless

- Fees are significantly lower than traditional banks

- It’s secure, transparent, and crypto-friendly

In short, we’ve built a banking experience that fits the way the world actually works today—global, digital, and connected.

Why Blockchain Technology in Banking Matters

When people hear “blockchain,” they often think of cryptocurrency. But blockchain technology in banking goes way beyond that. It’s about trust, efficiency, and transparency.

Here’s what makes it special:

- Immutable: Once a transaction is confirmed, it can’t be changed.

- Decentralized: No single institution controls it.

- Secure: Advanced encryption keeps data safe.

For banks, it means reduced fraud and lower compliance costs. For customers, it means faster, cheaper, and more reliable transfers. That’s a win-win—and it’s exactly what oneBanking delivers.

Blockchain Technology in Finance: Changing the Game

The impact of blockchain technology in finance isn’t limited to big banks. It’s empowering individuals, small businesses, and startups to move money effortlessly around the globe.

Freelancers can get paid instantly. Entrepreneurs can pay suppliers abroad without sky-high wire fees. Families can send remittances home and have their loved ones receive the full amount—not what’s left after deductions.

By simplifying and securing financial transactions, blockchain is creating a more inclusive and accessible financial world—one that oneBanking is proud to be a part of.

How Does Blockchain Reduce International Money Transfer Fees?

Let’s break it down simply:

- No Correspondent Banks: Blockchain connects sender and receiver directly, cutting out costly middle layers.

- Less Paperwork: Automated smart contracts handle verification, so there’s no manual processing or delays.

- Lower Overheads: With fewer people involved, operational costs drop—and those savings go straight to users.

- Fair Currency Conversion: By using crypto and stablecoins, oneBanking avoids inflated exchange rates.

The result? Transfers that are fast, transparent, and affordable—the way money movement should be in 2025.

Why Choose oneBanking?

At oneBanking, we’re not just adopting blockchain—we’re reimagining banking around it. Our blockchain banking system combines security, simplicity, and speed.

Here’s why users trust us:

- Real-time international transfers powered by blockchain

- Transparent exchange rates with no hidden fees

- Crypto and fiat support in one easy app

- Secure transactions with full compliance

With oneBanking, you don’t need to understand every detail of blockchain—you just need to enjoy the benefits it brings.

Conclusion

Blockchain banking isn’t the future; it’s the present. It’s already changing how the world moves money, making it faster, cheaper, and more transparent.

At oneBanking, we’re proud to lead that change. By using blockchain in banking and crypto banking, we’re helping people send money globally without borders, limits, or excessive fees.

With oneBanking, you get modern banking that actually works for you—not against you.

FAQs

Q. What is blockchain in banking?

It’s a digital system that records transactions securely and transparently without needing traditional intermediaries like correspondent banks.

Q. What is blockchain technology in banking?

It’s how banks use blockchain to make transactions faster, safer, and more affordable—improving everything from payments to compliance.

Q. What is blockchain technology in finance?

It’s the wider use of blockchain to modernize financial systems, reduce costs, and make money movement more efficient globally.

Q. How does blockchain reduce international money transfer fees?

By removing middlemen, automating settlements with smart contracts, and using crypto for faster, cheaper transactions.