Fintech payment solutions are the very heart of the global financial turn in 2025. Stronger, faster, and safer than ever, FinTech is changing the way money moves and is managed.

According to Statista, by 2025, the transactional value of the global digital payment market will reach over $15 trillion, with fintech apps making nearly 68% of all online transactions. As many as over 75% of consumers now prefer to use fintech apps rather than traditional banks due to lower fees and convenience.

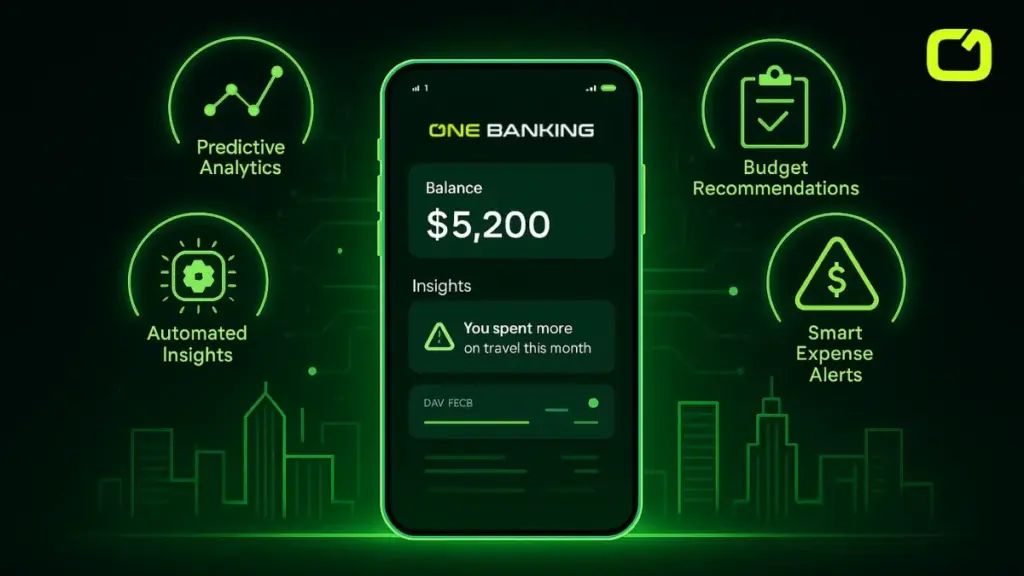

At oneBanking App, we reimagine the future of digital payments by delivering seamless, low-cost, and transparent solutions that empower people and businesses to save more and spend smarter.

This year, fintech payment innovation is about one thing: efficiency. Whether through AI in automation, instant transfers of cash, or zero-fee banking, the right fintech apps can make a big difference to your financial life. Here’s how the oneBanking app and the newest fintech trends in 2025 will help you save money and stay ahead of the curve.

Why Fintech Payment Solutions Matter More Than Ever

Traditional banking is slow, expensive, and often inconvenient. Fintech payment solutions like the oneBanking app solve this by putting speed, transparency, and flexibility at the forefront. Rather than relying on outdated systems, fintech platforms employ cloud technology with AI and automation to make such payments smoother and cheaper.

Users can now:

- Send and receive money instantly

- Manage multiple currencies

- Access lower fees for international transactions

- Enjoy a 24/7 digital banking experience

These features make fintech the smarter alternative to traditional banks. With oneBanking app, you get everything you need in one place: savings, payments, analytics, and security—built for the digital age.

How Can Fintech Help You Save Money?

The key reason why fintech is booming? It saves your money persistently. Contrary to conventional banks with their hidden fees, fintech payment platforms like oneBanking App keep running a lean, technology-driven system to minimize costs and pass the savings on directly to you.

Here’s how fintech makes saving simple and smart:

- Zero Hidden Fees: Transparent pricing with no surprises.

- Low-Cost Transfers: International and domestic payments at a fraction of traditional rates.

- AI-Based Spending Insights: Smart analytics that highlight where you can cut unnecessary expenses.

- Budget Automation: Automated bill tracking and payment reminders to avoid late fees.

- Reward and Cashback Offers: Get rewarded for everyday transactions made through the app.

In 2025, money management isn’t just about saving; it’s about optimizing. The oneBanking app helps you do both effortlessly.

The Future of Digital Payments

The future of digital payments is frictionless and intelligent. In 2025, speed and security are no longer luxuries; they’re expectations. With biometric verification, blockchain integration, and predictive analytics, fintech payment solutions are revolutionizing the way people interact with money.

Here’s what’s driving the change:

- Biometric Security: Facial and fingerprint recognition for fast, secure access.

- Blockchain Transactions: Transparent and tamper-proof transfers for international use.

- AI Fraud Detection: Real-time monitoring and alerts for suspicious activity.

- Multi-Currency Support: Manage multiple accounts and currencies from one dashboard.

At oneBanking App, these features are not futuristic—they’re standard. The app’s intelligent payment ecosystem ensures that your money moves faster, safer, and smarter than ever before.

Top Fintech Payment Apps in 2025

Competition in fintech is fierce, but a few names lead the space thanks to their reliability and innovation. As of 2025, these are the top fintech payment apps making headlines:

- oneBanking App: A complete financial ecosystem combining payments, budgeting, and global money management in one app.

- Wise (TransferWise): Best for low-cost global transfers.

- Revolut: A multi-functional app for banking, travel, and crypto.

- Stripe: Powerful for businesses and eCommerce.

- Payoneer: Trusted by freelancers and small businesses for cross-border payments.

What sets the oneBanking app apart is its unified approach, merging the best of fintech banking solutions into one intuitive platform.

Fintech Trends 2025: What’s Next for Digital Finance

The fintech trends of the 2025 landscape are defined by personalization, speed, and security. With the world moving toward digital-first finance, fintech is focusing on smarter technology that simplifies financial decisions.

Here are the biggest trends shaping 2025:

- AI-Powered Financial Planning: Apps that automatically plan budgets and predict future expenses.

- Embedded Finance: Payments integrated seamlessly into apps, social media, and online stores.

- Decentralized Finance (DeFi): Peer-to-peer financial ecosystems built on blockchain.

- Sustainable Fintech: Green banking solutions that promote eco-friendly spending habits.

- Voice and Gesture Payments: Instant, touch-free transactions driven by smart devices.

The oneBanking app aligns perfectly with these fintech trends, combining innovation with real-world value to make digital banking simple and rewarding.

How to Choose the Right Fintech Payment Solution?

With so many fintech platforms available, choosing one that fits your lifestyle can be challenging. Here’s what to look for in a fintech payment solution in 2025:

- Security First: Look for strong encryption and real-time fraud detection.

- Transparent Pricing: No hidden fees or unclear exchange rates.

- Easy Integration: Should sync with your bank accounts, cards, and payment systems.

- User Experience: Clean, simple interfaces that make managing money easy.

- Multi-Currency Access: Essential for freelancers, travelers, and global businesses.

The oneBanking App checks every box, providing a modern, secure, and cost-effective financial experience that adapts to your needs.

The Future Belongs to Fintech

Fintech isn’t just restructuring the way we make payments; it’s actually changing the very notion of money. By 2025, fintech banking solutions, such as the oneBanking App, will enable users to be far more active in managing their finances through real-time visibility and intelligent automation.

It means improved cash flow and lower costs of processing for small businesses. To the individual, it’s convenience, control, and savings. These payment innovations being developed today are creating new global standards for access and efficiency.

Conclusion

Indeed, fintech payment solutions are taking over the world in 2025, and leading the charge is the oneBanking app. From zero hidden fees to AI-powered budgeting and instant payments, it is a perfect mix of convenience and savings.

With the oneBanking App, we will help you save money, simplify your finances, and get ahead in the changing future of digital payments. Whether you need personal expense management or are running a business, oneBanking App is your all-in-one financial partner for 2025 and beyond.

FAQs

1. What is the future of fintech in 2025?

The focus will be on AI, blockchain, and personalization to improve transparency and reduce costs.

2. How can fintech save you money?

By lowering transaction fees, cutting hidden costs, and automating expenses.

3. Best fintech payment platforms?

- oneBanking App

- Wise,

- Revolut

- Stripe

- Payoneer

4. Future of digital payments in 2025?

Smarter, faster, and contactless transactions powered by AI and blockchain.

5. Top fintech payment apps in 2025?

- oneBanking App

- Wise

- Revolut

- Cash App

6. Future fintech payment innovations?

Decentralized finance, biometric authentication, and AI budgeting.

7. What are fintech payment solutions?

Digital platforms that simplify and secure money transfers.

8. How can fintech payment solutions help save money in 2025?

By automating financial management and reducing transaction costs.

9. Which fintech apps are best for saving money in 2025?

- oneBanking App

- Revolut

- YNAB

10. Are fintech payment platforms secure and reliable?

Yes, apps like oneBanking use advanced encryption and fraud detection.

11. How do fintech solutions reduce transaction fees?

By using automation and cutting out intermediaries.

12. What are the most popular digital payment trends in 2025?

AI-driven finance, embedded payments, and DeFi.

13. Can small businesses benefit from fintech payment tools?

Absolutely, they save costs, streamline payments, and improve cash flow.

14. What is the difference between fintech payment apps and traditional banks?

Fintech apps are faster, cheaper, and entirely digital.

15. What should I look for when choosing a fintech payment solution in 2025?

- Security

- Transparency

- Affordability

- Smart Automation