If you manage a business, you know firsthand how much time and energy gets sucked away by clunky banking processes and outdated systems. It’s incredibly frustrating when you just want to focus on growth and serving your clients. What if there was a smoother, more intuitive way to handle your payments and money management? It turns out, there is.

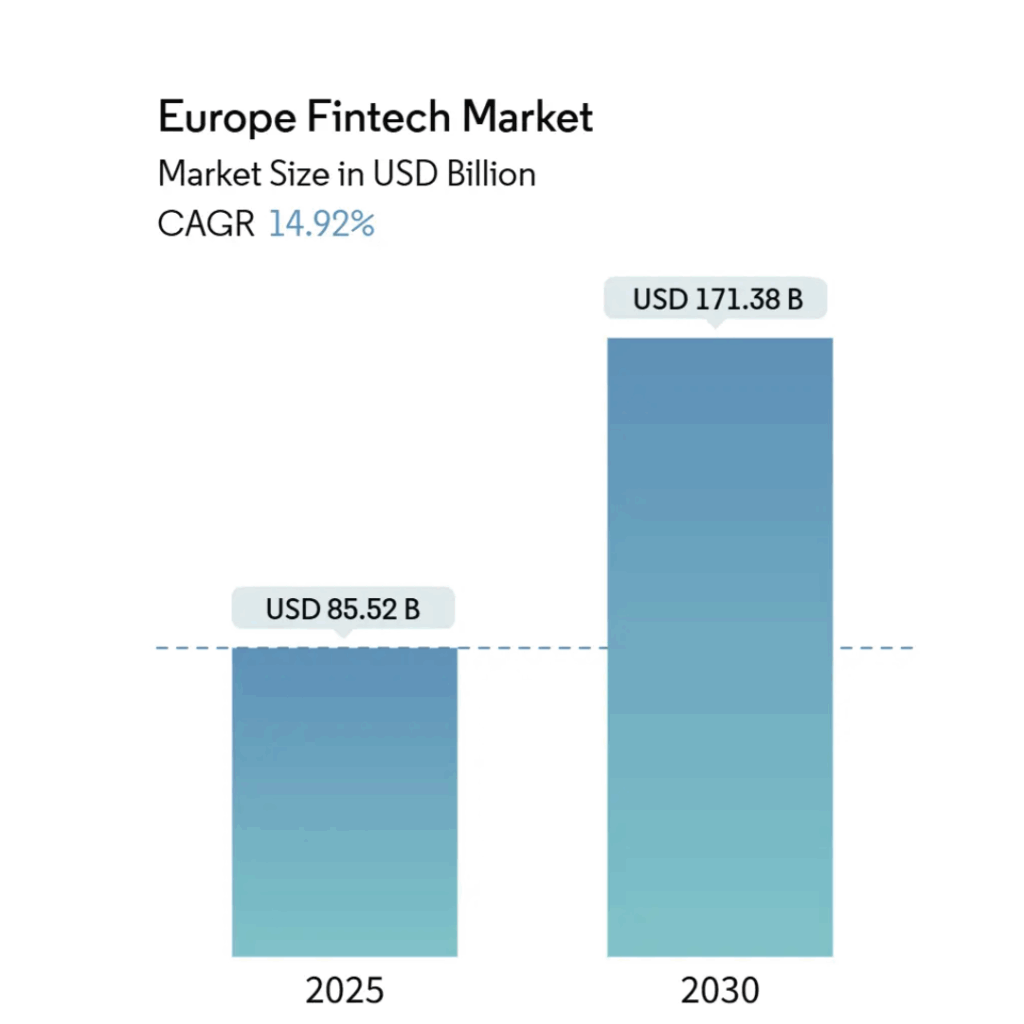

According to Mordor Intelligence, the European fintech market is expected to grow from $85.52 billion in 2025 to $171.38 billion by 2030, starting in 2024. This means that the market will grow at a compound annual growth rate (CAGR) of 14.92%, and there will be a medium level of market concentration during the forecast period.

With oneBanking at your side, a leading fintech app for business payments, your finances can actually work for you, not against you. Whether you’re curious about switching to fintech payments or actively looking for digital payment solutions for businesses, this might be exactly what you need. Faster vendor payouts, better tools, and a team that makes you feel supported—it can all be reality.

Why Traditional Banking Makes Business Harder

Let’s be real, running a business is enough of a challenge. Traditional banks seem to love adding extra speed bumps. Have you ever attempted to open a new business account? With piles of paperwork and countless forms, it’s similar to preparing for a journey across the ocean. This simply slows down the process for new and small businesses.

On top of that, the fees don’t make things any easier. Whether it’s sending money abroad, dealing with crypto, or handling simple transfers, you’re probably seeing extra charges at every step. Some banks even charge 4-5 percent for crypto payments. That eats into profits and makes it tough to keep your business lean.

Getting help can be even more maddening. If you’ve ever needed a fast answer about a payment or transfer, you probably found yourself explaining the situation to multiple people. Time lost equals money lost, especially for small ventures.

Plus, let’s be honest, most banking platforms weren’t made for the way today’s businesses move. Trying to see where your money is actually going? Good luck juggling all the spreadsheets and extra apps. It’s way more complicated than it has to be.

Fintech to the Rescue: What Makes It Different?

Modern business deserves better. That’s why fintech apps for business payments are catching on so quickly, and why oneBanking is leading the charge. Here’s how we’re making business banking feel, well, human again.

1. Quick and Hassle-Free Account Setup

Forget the paperwork pile and long trips to the bank. With oneBanking, you can sign up right from your laptop or phone. Are you a solo founder, a scaling startup, or running an NGO? We’ve built our process to be welcoming for everyone. Our range of packages grows with you, fitting your needs at every stage.

2. Transparent Pricing, No Meh Surprises

Surprise fees? No thanks. At oneBanking, what you see upfront is what you actually pay. There are no hidden costs lurking in the fine print or rising fees just because your business is growing. Since we work with many customers, we lock in better rates and pass those savings on to you, especially if you’re moving bigger amounts or using crypto. With our PRO+ account, your wallet will definitely feel the difference.

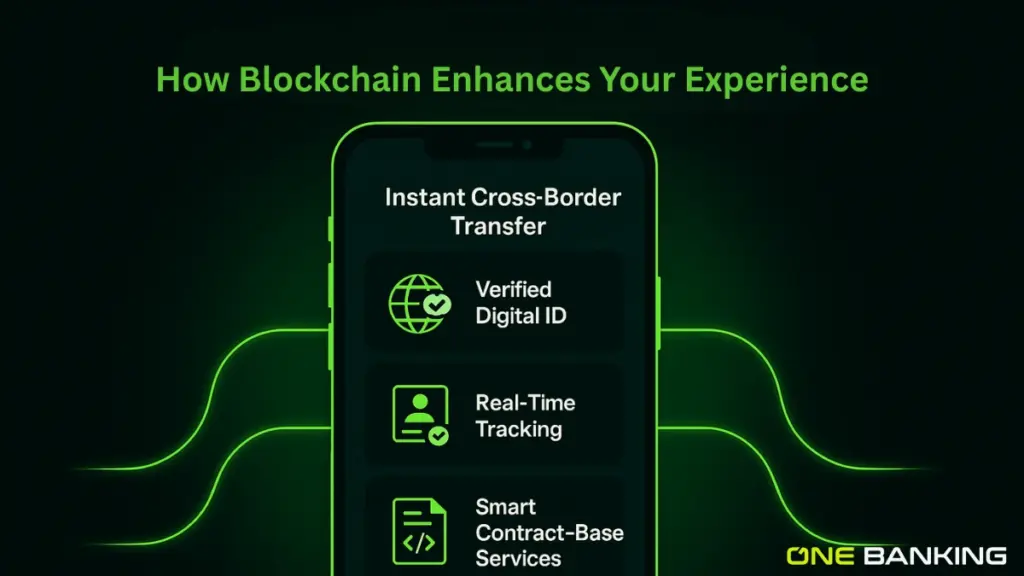

3. Paying Vendors Faster and Going Global

We get it, you don’t have time to wait around, and neither do your partners. That’s why we speed up payments, taking the stress off your shoulders. Contractors and suppliers get their money on time and you keep business relationships healthy. Our faster vendor payouts feature will make you wonder how you ever put up with slow banks.

If you’re operating internationally, you’ll appreciate our multi-currency support. Moving money between countries or currencies shouldn’t mean losing money on bad exchange rates. With oneBanking, it’s simple and fair to keep your business connected worldwide.

4. Support That Feels Like a Friend

No one wants to feel like a ticket number in some endless support queue. When you use oneBanking, you get quick access to real people who understand what your business is up against. We give you a real contact right in the app so you’ll never feel stranded. Friendly, knowledgeable help is just a tap away.

5. Security That Lets You Sleep at Night

We’re talking about your money, after all. With oneBanking, you get the best in data protection, using the latest security measures and strong encryption. And with our newest features, you stay in control—nothing happens with your info unless you say so. Your privacy, your decisions.

What’s Next? AI Is Making Banking Smarter

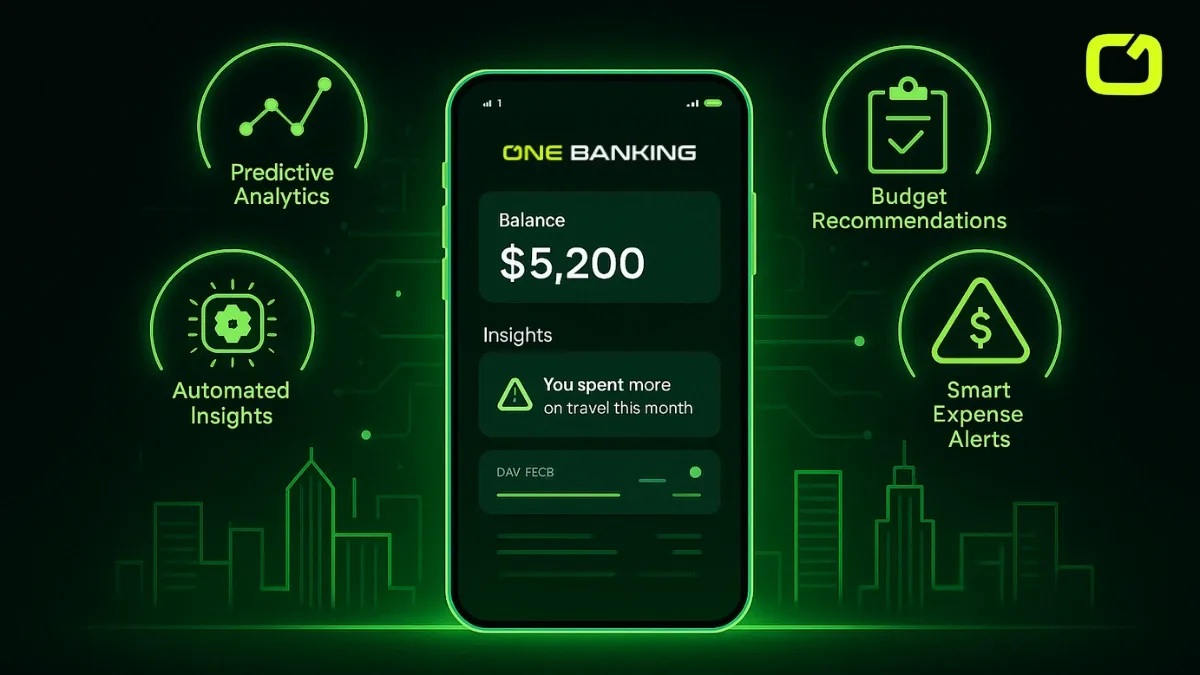

Banks should do more than just keep your money safe. That’s why oneBanking is rolling out AI-powered features to act as your personal finance coach. Picture this: your app notices a recurring payment you forgot about, reminds you before a contract renews, and even manages cancellations if you want. It’s not just convenient; it can save you real cash.

Do you have business insurance policies piling up? Our collaboration with industry pros helps our AI analyze your coverage, point out savings, and recommend tweaks—so you don’t overpay.

Most importantly, you’ll finally get clarity. Detailed breakdowns, smart suggestions, and all the insights you need to balance your books are right there, and privacy is always part of the package.

Ready for a Better Way? Here’s Why It Matters

Business is all about staying agile. You will be spinning your wheels and losing out on opportunities if you continue to use antiquated banking. By moving to fintech payments, you can save money and gain the freedom and flexibility you require. Forget about unexplained costs, antiquated technology, and exclusion.

OneBanking is not only a tool for finances. It was constructed by individuals who understand your needs because they have been there themselves. As you create, develop, and pursue your ambitious goals, we can’t wait to help. Try oneBanking if you’re searching for a fintech app for business payments that genuinely cares, provides quicker vendor payouts, and supports you with genuine service.

FAQs:

Q. What is a fintech app for business payments?

A fintech app for business payments is a modern money tool that gives your business speed, lower costs, multi-currency features, and useful extras, all inside a straightforward digital platform.

Q. Is switching to fintech payments difficult for a business?

Not at all. Signing up with oneBanking is designed to be fast and simple. No unnecessary paperwork. Whether you’re a new founder or part of a growing team, you’ll be on board quickly and ready to focus on what matters.

Q. How can digital payment solutions for businesses save me money?

The big benefit is in clear, low fees. No surprises or big charges when you grow. Our AI also helps spot waste and streamlines expenses. With oneBanking, you’ll see savings in both daily finance and crypto payments.

Q. How does a fintech app provide faster vendor payouts?

Digital platforms automate every step, so payments reach your contractors and suppliers quickly and reliably, keeping your business moving along.

Q. Is my financial data secure with a fintech app?

Absolutely. We’ve invested in top-shelf security and privacy features. You control what’s analyzed and nothing happens unless you say so. You stay protected, always.

Q. What kind of support can I expect?

You’ll always have access to a helpful real person, right through your app. No bouncing around from department to department.

Q. Can a fintech app support my business as it grows?

Definitely. OneBanking is built to grow along with you, whether you’re just starting, scaling up, or serving clients worldwide.