Let’s be honest; banking used to be a pain. It all seemed old-fashioned to stand in line, fill out papers, and wait for business hours. With a digital bank app, managing your money has become simple, fast, and surprisingly enjoyable. You don’t have to go to a bank to send money, keep track of your spending, or even obtain financial advice.

But it’s important to know what to look for when you download an app. There are differences between mobile banking applications. Some digital banks concentrate on being simple, while others focus on having a lot of features.

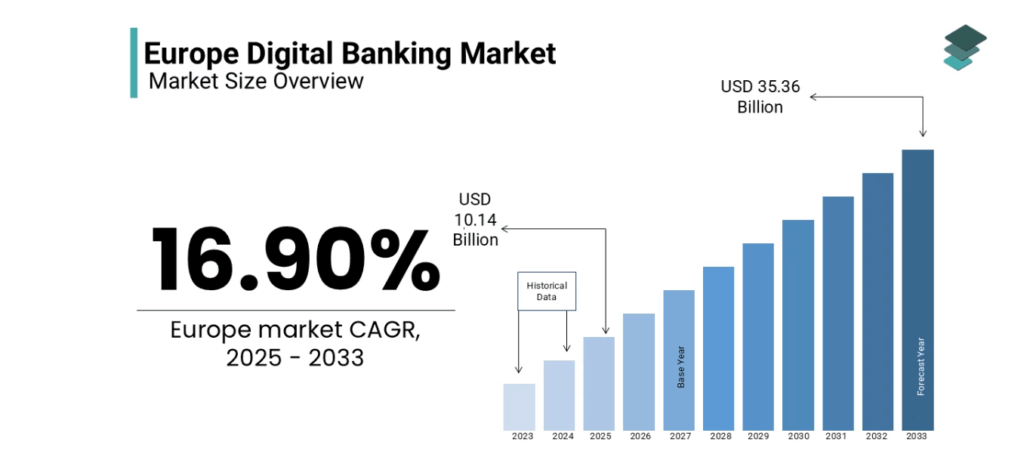

According to Market Data Forecast, in 2024, the digital banking industry in Europe was valued at $8.67 billion. The European market is expected to increase at a rate of 16.90% per year from 2025 to 2033. Hence, going from USD 10.14 billion in 2025 to USD 35.36 billion by 2033. onebanking is one of the finest digital banks in Europe and is one of the few that does both and adds something extra: actual human service and smart financial tools for daily life.

source: Market Data Forecast

What a Digital Bank App Really Is

A digital bank app is your bank in your hand. Everything happens online. You can open an account, send money, save for goals, and even invest—all from your phone.

But here’s where things get interesting. The best online banking apps today don’t just handle transactions. They actually help you understand your finances.

Take onebanking, for example. It’s not just about sending money or paying bills. Its financial AI looks at your spending and saving habits, gently coaching you toward better financial balance. It’s like having a personal finance coach, but one that never sleeps.

What to Check Before Downloading a Digital Bank App?

Before you install any fintech banking app, do a quick checklist. It will save you time (and maybe a few headaches) later.

- Security Comes First

Always make sure the app uses top-grade encryption and offers features like fingerprint or face ID login. Your financial data is personal—it should stay that way.

- Licensing Matters

Look for a digital bank that’s officially licensed in Europe. Apps like onebanking follow strict banking standards so your money stays protected.

- Ease of Use

Banking should be easy, not overwhelming. The layout should be clean, and the experience should feel smooth. If it feels confusing at first glance, that’s a red flag.

- Customer Support

When something goes wrong, you don’t want to talk to a chatbot that doesn’t understand you. onebanking gives you a real person to chat with directly through the app whenever you need help.

- Fair and Transparent Fees

No one likes hidden costs. Look for clear, upfront pricing. onebanking is known for keeping its fees low, even for crypto transactions, and for passing savings straight back to customers.

How to Choose the Right Digital Bank App?

Choosing a digital bank app depends on your needs. Here are a few things to think about:

- Smart Features

AI-driven insights can be life-changing. The Financial AI in onebanking tracks your income and expenses, then gives you gentle nudges to save more or spend smarter.

- Multi-Currency Options

If you travel often or deal with international clients, a mobile banking app that supports multiple currencies will make your life easier. onebanking handles that effortlessly.

- Business-Friendly Tools

If you’re self-employed or running a business, accounting integrations are a huge plus. Fintech banking apps like onebanking are already planning built-in accounting features to simplify your work life.

- Rewards and Gamification

Who said banking has to be boring? onebanking rewards you for using the app. You learn more about your finances, stay engaged, and get something in return.

Why is Digital Banking Taking Over?

It’s easy to see why more people are switching to online banking apps. They offer flexibility, simplicity, and freedom that traditional banks can’t match.

- You can manage your money anytime, anywhere.

- Fees are often lower, and transactions are faster.

- AI tools give you insights traditional banks never could.

- Everything is digital, so it’s more sustainable.

- Global access makes travel and business smoother.

Online banking combines all these benefits while keeping a strong human touch. It proves that banking can be both smart and personal.

Things to Know Before Using Online Banking Apps

Before you dive in, here are a few practical tips for staying safe and making the most of your digital banking experience:

- Use strong, unique passwords for your accounts.

- Keep your app updated to get the latest security features.

- Check your transactions regularly for anything unusual.

- Avoid public Wi-Fi when logging in.

- Read the app’s privacy policy. Apps like onebanking only analyze what you allow, keeping your information private.

Little habits like these help you enjoy all the benefits of digital banking without worry.

How Is AI Changing Fintech Banking Apps?

Artificial intelligence is no longer a buzzword—it’s reshaping how we handle money.

In fintech banking apps like onebanking, AI works quietly in the background to make your life easier. It can remind you when a subscription is about to renew, help you find better insurance deals, and even coach you toward saving more.

And because privacy matters, onebanking’s AI only looks at what you choose to share. That means your financial data stays yours, always.

Why Does onebanking Stand Out as the Best Digital Bank in Europe?

So, what makes onebanking different from all the other mobile banking apps?

It’s the combination of smart technology, real human service, and fair pricing. Here’s what you can expect:

- Honest and transparent fees that stay low.

- Support for multiple currencies.

- Financial AI that helps you take control of your money.

- A friendly team ready to assist you whenever you need help.

- Rewards and gamified features that make banking actually enjoyable.

Whether you’re managing your personal budget or growing your business, onebanking gives you the flexibility and insight to do it with confidence.

Conclusion

Getting a digital bank app isn’t only easy; it’s also a way to take control of your money future. If you have the appropriate software, managing your money may be simpler, wiser, and even a bit more fun.

onebanking is the greatest digital bank in Europe. If you want a partner that combines trust with technology and fairness with innovation, this is a wonderful place to start. It’s banking in the contemporary world, but with a personal touch.

Check out the app’s privacy policy. Apps like onebanking only look at the data you provide them, so your information stays private.

FAQs

Q. What is the best digital bank in Europe?

The best digital bank in Europe offers transparency, innovation, and great customer support. onebanking checks all those boxes with its AI-driven features and personal service.

Q. How to choose a digital bank app?

Look for strong security, clear pricing, and easy navigation. Smart features like financial coaching are a big plus.

Q. What to check before downloading a digital bank app?

Check for official licensing, strong data protection, transparent fees, and reliable customer support.

Q. What are the things to know before using online banking apps?

Use secure passwords, keep your app updated, review your transactions often, and understand how your data is used.