Global money movement is changing faster than ever, and the conversation around Crypto vs Traditional Banking is impossible to ignore. More and more people and businesses use cross-border transfers for employment, vacation, investments, and ordinary money requirements every year. According to the Bank of England, global cross-border payment flows are expected to exceed 250 trillion USD by 2027. This shows how important it is to make international transactions quicker, cheaper, and more efficient.

Traditional banks are still the most important part of the financial system, but cryptocurrencies are changing things with their speed, cheap costs, and 24/7 availability. Platforms like oneBanking make it easier to obtain the best of both worlds by giving you a single experience that blends the dependability of banks with the speed of crypto.

So which system really delivers when it comes to global transactions? Let’s break down the key differences and find out.

Quick Comparison Table

Here’s a quick side-by-side look at how traditional banking and cryptocurrency compare across key factors for global transactions.

| Feature | Traditional Banking | Cryptocurrency |

|---|---|---|

| Speed | Slow, 1–5 days | Fast, seconds to minutes |

| Fees | High, 1–3 percent | Low, around 1 percent or less |

| Availability | Limited to bank hours | Available 24/7 worldwide |

| Regulation | Highly regulated | Regulation still evolving |

| Security | Centralized protection | Cryptographic and decentralized |

| Global Use | Universally accepted | Growing acceptance |

| Control | Controlled by institutions | Controlled by users |

Why This Comparison Matters Today?

The financial world in 2025 looks completely different from just a few years ago. Banks have stepped up their digital game with AI-driven customer support, real-time data systems, and mobile-first apps. At the same time, crypto networks have exploded in capability. Some blockchain solutions now process up to one million transactions per second, leaving even traditional card networks struggling to keep up.

People are sending money internationally for everything from paying suppliers to supporting family members abroad. So it’s important to understand how Crypto vs Traditional Banking performs in real-life scenarios, not just in theory.

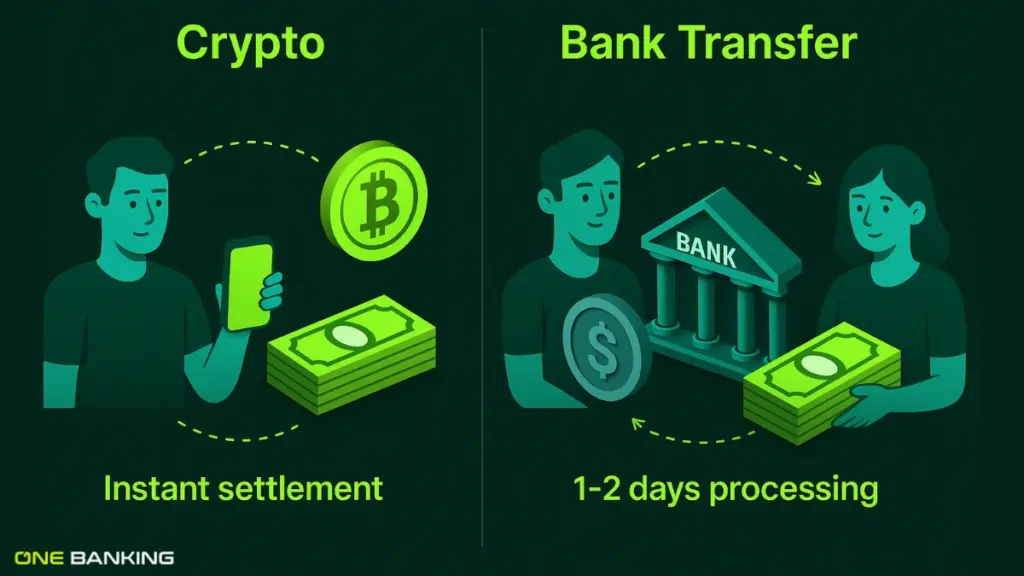

Speed: Crypto Pulls Ahead

If you have ever sent an international bank transfer, you know the drill. The money might take anything from one to five business days to get to the opposite side. Banks use networks like ACH and SWIFT, which go through a number of middlemen. Each checkpoint introduces delays, manual checks, and processing times.

Crypto works very differently. Because it uses decentralized networks, transfers settle within minutes, sometimes seconds. And with solutions like the Lightning Network, speed is no longer even a question. The technology simply outperforms traditional rails.

In simple terms:

- Bank transfers are slow, often taking days

- Crypto transfers are fast, usually completed in minutes

For anyone who values speed, crypto is clearly the more efficient choice.

Fees: The Hidden Battle

Traditional banking fees are no joke. A single international wire can cost anywhere from 15 to 50 euro before you even consider the currency conversion markup. Credit card transactions also come with processing fees ranging from one to three percent, which adds up quickly for businesses.

Crypto transactions generally cost much less. Many networks operate with fees around one percent or lower. Even when networks become busy, the overall cost typically stays well below what banks charge.

This is where oneBanking shines. With crypto transaction fees starting at just 0.1 percent, users get one of the lowest-cost options on the market for sending money across borders.

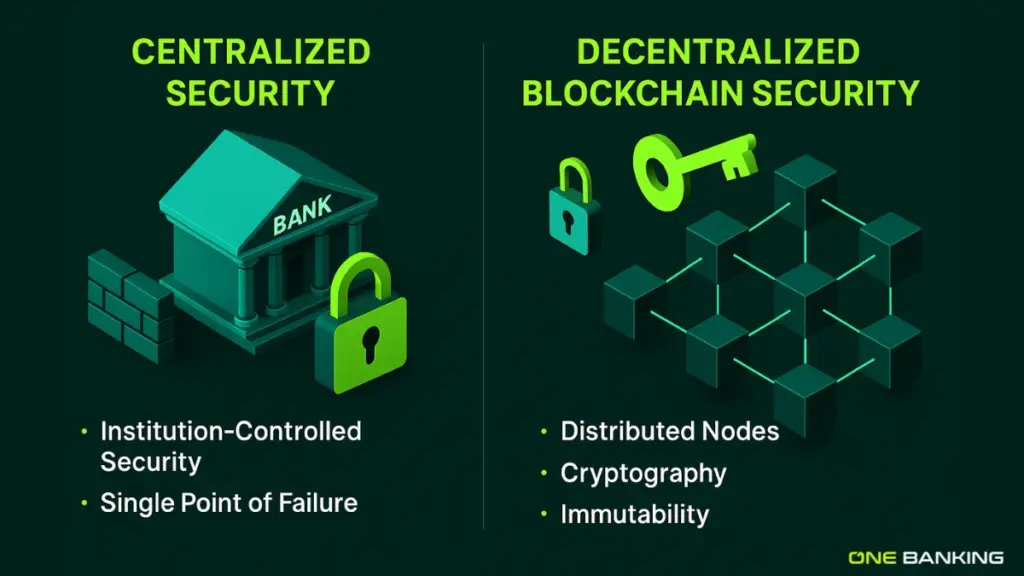

Security: Two Different Safety Models

Traditional banks follow strict regulations and security protocols. This includes

- Deposit insurance

- Fraud monitoring systems

- Compliance checks

- Consumer protection policies

These protections make banks stable and predictable.

Crypto utilizes a new kind of security. Advanced cryptography and distributed networks are what make blockchain technology function. Transactions are saved forever, which makes it very hard to change or modify them. There is no one point of failure, which greatly lowers some kinds of cyber hazards.

However, users must take responsibility for wallet security. Losing a private key or falling for phishing scams can cause permanent loss.

Here, the oneBanking app offers a balanced approach. With secure partners like BVNK, OKX, FinchTrade, and hardware wallet integration through Tangem, users can enjoy both institutional-grade protection and the security benefits of decentralized networks.

Accessibility, Convenience Without Boundaries

Banks operate on business hours, and even though mobile banking exists, many processes still follow traditional settlement windows. International transfers may pause on weekends or holidays.

Cryptocurrency never sleeps. No matter where you are on Earth, networks work all the time. You only need a digital wallet and an internet connection.

This ongoing access is a big deal for people who work from wherever, digital nomads, and internet enterprises.

oneBanking makes it easier to use by giving customers both fiat and crypto wallets on the same site. This helps them switch between currencies right away, without having to wait for bank hours.

Real-World Impact: What Users Actually Feel

Let’s have a look at the real world impacts:

For Everyday Users

Sending money abroad is faster and cheaper with crypto. Fees are low, settlement is almost instant, and you avoid conversion markups from banks.

For Freelancers and Remote Workers

Crypto lets you receive payments globally without relying on slow banking networks. No waiting days for funds to arrive.

For Businesses

Crypto can cut payment processing costs dramatically. It also helps companies pay international suppliers or employees without expensive banking intermediaries.

For Travelers

Using crypto avoids ATM withdrawal fees, local banking restrictions, and unpredictable conversion rates.

With the oneBanking app, users can manage all these scenarios easily since the app combines fiat accounts, crypto wallets, and a smart reward system, making every financial action more efficient.

Which Should You Choose?

The truth is, both systems have strengths and weaknesses. It really depends on what you need.

Traditional banking makes sense if you want

- Deposit insurance

- Institutional stability

- Broad merchant acceptance

- Access to loans and credit products

Crypto makes sense if you want

- Fast international transfers

- Lower global transaction costs

- 24/7 access

- Control over your digital assets

The best option for most people is a hybrid approach. And that is exactly why the oneBanking app was built. The platform brings together the stability of traditional banking with the innovation of cryptocurrency. You get:

- IBAN with Visa

- Crypto transfers starting at 0.1 percent

- Multi-chain support

- Rewards for nearly every action

- A smart AI financial coach

- Secure global partners

It is the easiest way to enjoy the advantages of both systems without juggling multiple apps or accounts.

Conclusion

The debate of crypto vs traditional banking isn’t about choosing one winner. Instead, it’s about knowing which approach works best for your unique financial situation. Crypto is quicker, cheaper, and available all across the world. Traditional banking, on the other hand, is stable and carefully regulated.

The real future lies in combining both strengths. Platforms like oneBanking make this possible by offering fiat and crypto features in a single, secure, and user-friendly app. If you want to experience a smarter, more efficient way to handle global transactions, oneBanking is ready to become your number one financial partner.

Crypto is fast, low-cost, and global. On the other hand, banks are secure and regulated. oneBanking gives you both in one app.

Not yet. Banks handle loans, savings, and stability. However, crypto shines in fast, cross-border transfers. oneBanking merges the advantages of both.