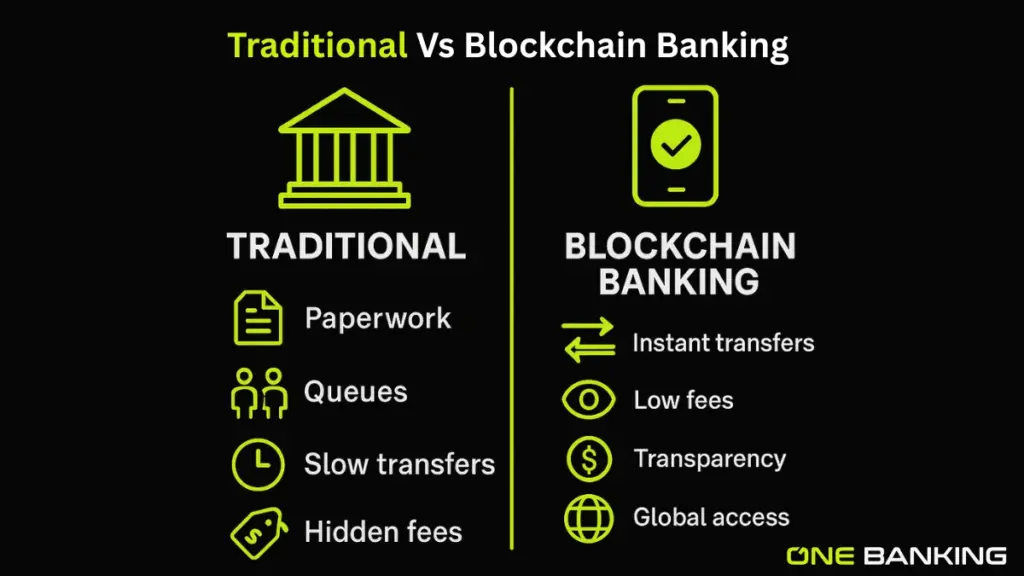

We can’t deny that the banking industry is undergoing profound transformations at the moment. For ages, traditional banking has been the comfortable default. You imagine old-school bank branches, lineups, paperwork, and parental habits.

In fact, as of 2025, 90% of US and European banks were already exploring blockchain technology for payments, reconciliation, and record-keeping (TekRevol’s). What differentiates Blockchain Banking from traditional banks? And even more importantly: is blockchain actually a better choice? That’s what we’re unpacking today, and at oneBanking, we know this world inside out, bringing you a banking experience that’s simple, secure, and refreshingly transparent by using the best of blockchain technology in banking.

In this guide. we’ll compare them, explain how they operate, and give you the down-low so you can decide which one matches your financial habits.

What is Traditional Banking?

Start with your likely familiarity. Think about a brick-and-mortar bank: the tellers, the forms, the waiting area, and possibly a vault behind closed doors. That’s traditional banking for you. In this setup, the big institutions—commercial banks, credit unions, all those household names—are in the driver’s seat. They manage your savings and loans, help you move cash, approve credit, and basically run the whole show.

Centralization is the key word here. Every transaction runs through main servers and layers of staff, and every bank is regulated by heavyweight government bodies like the Federal Reserve or the European Central Bank. It’s been a sturdy system for decades, and most people find it reassuring. But, let’s be honest, it can drag—transactions aren’t exactly speedy, fees can pop up everywhere, and things can get murky instead of transparent.

How Blockchain is Changing Banking?

So what’s all the buzz about Blockchain Banking? Glad you asked! Blockchain basically rewrites the rulebook. There’s no bossy head office—blockchain technology takes over with a global digital network that keeps everything running smoothly. Most people hear blockchain and think of crypto like Bitcoin, but honestly, the impact goes way past just digital currency.

Let’s break it down simply: Imagine an online ledger that’s not tucked away in a single office. Instead, it’s updated in real-time across thousands of computers all over the planet. Whenever you make a transaction, the info is locked in place using smart, unbreakable code. And instead of a few people at the top calling the shots, everyone in the network can help check the facts.

At oneBanking, we live and breathe this approach. We’ve mixed the perks of fast, intuitive digital banking with the backbone of open, robust blockchain. Want to send money to your cousin in another country and have it land within minutes, not days? Or maybe you’re curious about swapping crypto with fees starting as low as 0.1%? That’s what modern blockchain platforms like ours are built to deliver.

Blockchain vs Traditional Banks

This issue boils down to centralization vs. decentralization. Switching it on changes speed, cost, who runs your money, and how transparent the process is.

Take a look at how it adds up in practice:

| Feature | Traditional Banking | Blockchain Banking |

|---|---|---|

| Structure | Centralized: the bank runs everything | Decentralized: the network shares responsibility |

| Trust | Built on trusting your financial institution | Built on cryptography and network consensus |

| Transparency | Most info hidden, only the bank sees it | All transactions can be checked and verified |

| Transaction Speed | Slow, cross-border especially | Fast, often in just seconds or minutes |

| Fees | Fees everywhere and they add up | Very low costs—big savings for you |

| Accessibility | Tied to physical branches and local hours | 24/7 online access from anywhere |

| Security | Vulnerable if the institution gets hacked | Security is distributed and tamper-resistant |

| Data Control | Bank owns your financial data | You own and manage your data directly |

How Blockchain Banking Works Compared to Traditional Banking?

Let’s put this into a real-life scenario for you: say you’re transferring money to a friend abroad.

If you do this with traditional banking, your money zigzags through several institutions and clearinghouses. It’s almost like your money is on a layover-heavy flight, with extra checks, paperwork, and delays at every stop. Every player along the route charges a little fee. You wait—from a day up to nearly a week—and hope all the rates and conversions come out in your favor.

Now imagine Blockchain Banking. Here’s the difference: You hit “send,” your transaction pings the worldwide network instantly, and across the globe, computers race to validate, timestamp, and lock it in place using cryptography. There’s no patchwork of companies or waiting for closing times. Once verified, it’s set in stone—your friend gets the money fast, and you barely lose a cent to overhead.

This is what we’re always working on at oneBanking. No layers of middlemen, no hidden fees. Want to juggle different currencies, score competitive crypto exchange rates, and actually see what’s happening at each step? It’s all possible, and it’s the way we think banking should work.

Pros and Cons of Blockchain Banking

Alright, so is Blockchain Banking perfect? Not quite! But it really shines in some areas, even if there’s room for improvement elsewhere.

What’s Awesome:

- Stellar Security: Tampering and fraud are difficult since the blockchain isn’t locked in one office and every block is encrypted.

- Big-Time Transparency: No one can hide devious transactions since anybody can inspect the chain.

- Lightning Speed: No more long processing times—get ready for payments and transfers that zip by, sometimes in seconds.

- Lower Fees: Without a long line of banks and agents taking a cut, you keep far more of your money.

- Access for All: You don’t have to live near a branch or jump through hoops. Having Internet access is enough.

Where It’s Still Catching Up:

- Incomplete Rules: Laws, laws, and compliance processes for blockchain are still evolving globally.

- Network Traffic Jam:Overuse of the network slows it down, although emerging technologies are fixing this.

- Energy Use: Older blockchain networks require a lot of power, while newer ones are greener.

- Learning Curve: It can sound geeky at first, but platforms like oneBanking are designed to be as easy as possible—no PhD required.

At oneBanking, we’re always tweaking things to be as user-friendly and transparent as possible. Our app is smooth and simple, our support team is always there for you, and our licensed global partners mean you never have to worry about your money being safe.

Why Blockchain Banks Are Gaining Popularity?

You may have heard friends or online forums discussing Blockchain Banking. Why the hype?

- You Control: Only you can manage your money and personal info. There’s no waiting for slow approvals or worrying if someone at a branch can access more than you’re comfortable with.

- Always Evolving: Startups like oneBanking are leading the charge. For example, our app offers an AI-powered financial coach—helping you plan, save, and spend smarter while still keeping your information totally private.

- Banking with Perks: At oneBanking, we gamify the process. Rewards for every swipe, transfer, or crypto purchase make daily banking more enjoyable and lucrative.

- All in One Place: Avoid lots of applications and accounts. Convert, transfer, and get top-market rates for euros, bitcoin, and more in one app.

Is Blockchain the Future of Banking?

Let’s be honest, the future is already here. Even the most traditional banks are investigating and adopting bits of blockchain technology—sometimes behind the scenes, sometimes in brand-new products. But the platforms that were built for this from day one, like oneBanking, are moving faster, adapting to what people really want: security, access, speed, and transparency.

Conclusion

Which one should you pick—Blockchain Banking or Traditional Banking? The answer depends on what you’re looking for in your day-to-day financial life. If speed, lower costs, complete transparency, and control sound good, blockchain-powered options are worth a try. If you prefer face-to-face connections and the old ways still work for you, classic banks are still around.

At oneBanking, we’re setting a new standard. With trusted international partners, rock-solid security, and a focus on simplicity, we bring together blockchain and AI so you get smarter, safer, and more enjoyable banking—all in one place. Why not see for yourself how next-generation banking can transform your money management?

FAQs:

Traditional banking is the system most of us grew up with—run by banks and credit unions, closely regulated, and heavily centered around in-person service and paperwork.

Traditional banks are centralized—one authority handles your money. Blockchain technology decentralizes control, letting decisions and record-keeping happen all over a shared network.

It’s making things quicker, more affordable, and vastly more transparent. With blockchain, you actually see where your money goes.

Blockchain banks verify transactions digitally with no human error, red tape, or time zone issues—meaning your payments get done faster and safer.

Pros are speed, security, transparency, and low fees. The cons? Regulation is still catching up, the technology can be confusing at first, and network slowdowns can still happen on older systems.

It’s headed that way! As more banks try adopting these ideas and more startups build user-friendly blockchain platforms, the change isn’t slowing down.

People want control, lower costs, and easier access—blockchain banks check all those boxes, making them a hot topic in fintech.

Think about control (blockchain puts it in your hands), transparency, fees (way lower with blockchain), and who actually “owns” your data.

Pingback: Crypto vs Traditional Banking: Which Is More Efficient for Global Transactions?