If there’s one thing everyone has realized by 2025, it’s that Bitcoin is no longer just “digital gold.” Sure, it’s still a powerful store of value, but the world is finally using Bitcoin the way it was meant to be used: for payments, transfers, financial access, corporate reserves, and much more.

The shift is real: in 2025, a leading survey found that 39% of crypto holders report using cryptocurrencies to purchase goods or services, highlighting how crypto is moving into everyday financial life (source: Gate.com). And with apps like oneBanking, these everyday use cases have become smoother, faster, and far more practical.

Today in this article, we’ll break down the top BTC use cases that everyday people, businesses, and even governments are adopting in 2025. Furthermore, you’ll explore how oneBanking makes the entire experience seamless.

1. Bitcoin as a Real-Time Global Settlement Layer

One of the biggest shifts in 2025 is that Bitcoin has evolved into a global settlement network. Institutions, fintechs, and even traditional banks now use Bitcoin’s blockchain to move large amounts of money quickly and securely.

Why? Because Bitcoin moves value in minutes, not days.

Businesses now choose Bitcoin settlement because:

- It works 24/7 worldwide

- Fees are predictable

- Middlemen are reduced

- Cross-border friction disappears

The oneBanking app integrates with partners like Kraken, FinchTrade, and OKX so users can access instant liquidity without dealing with complicated exchange platforms. Whether you’re sending BTC, converting it, or using it for business settlements, everything happens in one app.

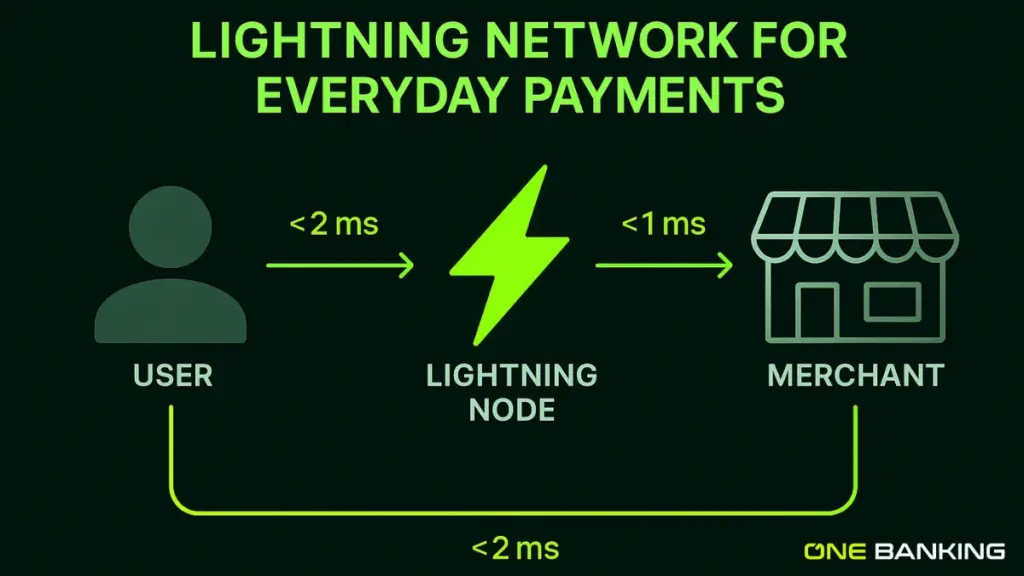

2. Bitcoin Payments via Lightning Become Everyday Reality

In 2025, Lightning payments are no longer niche. They’re normal.

You can buy coffee, pay freelancers, tip creators, subscribe to services, and even pay utility bills using Bitcoin through the Lightning Network.

What changed?

Lightning brought:

- Millisecond payments

- Ultra-low fees

- Easy integration for merchants

- Smooth user experience

And because oneBanking merges fiat and crypto wallets, users can pay however they want, instantly switching between euros and Bitcoin without dealing with multiple apps.

This is where Bitcoin stops being a speculative asset and becomes an everyday tool.

3. Bitcoin as a Long-Term Financial Hedge

Economic uncertainty in 2025, from inflation cycles to currency volatility, has strengthened the perception of Bitcoin as a hedge. Now this isn’t just theory; it’s backed by adoption data.

The biggest reasons Bitcoin remains a top long-term store of value:

- Fixed 21M supply

- Transparent issuance

- Growing institutional demand

- Strong global liquidity

- Regulatory clarity in major markets

People want assets that can’t be inflated away. Bitcoin fits that role perfectly.

With low trading fees starting at 0.1%, oneBanking gives users a low-cost, regulated way to buy, store, and track their holdings without bouncing between apps or exchanges.

4. Bitcoin in Corporate Treasuries

If 2021-2023 were early adopters, then 2024-2025 became the turning point. More companies now keep a portion of their treasury in Bitcoin.

Reasons behind the shift:

- BTC protects long-term purchasing power

- It offers liquidity for global operations

- It diversifies away from weakening fiat currencies

- It builds trust with crypto-aware customers

Even small and mid-sized businesses are engaging.

With partners like BVNK powering business IBAN accounts and compliance layers, the oneBanking app gives companies secure access to crypto treasury tools while keeping everything licensed and transparent.

5. Bitcoin-Backed Credit and Loans

One of the top BTC use cases gaining momentum is Bitcoin-backed borrowing. Instead of selling BTC during a bull run and missing out on future gains, users lock their BTC as collateral and borrow cash against it.

Advantages:

- Keep long-term BTC exposure

- Don’t trigger taxable events

- Access liquidity instantly

- Manage finances more strategically

This model is becoming a staple for high-net-worth investors, businesses, and everyday crypto users.

As one banking app continues developing investment and financial products, this type of BTC-backed financing will integrate smoothly into its ecosystem—giving users modern financial freedom without giving up their Bitcoin.

6. Bitcoin for Remittances and Global Transfers

Traditional remittances are expensive, slow, and often unreliable. In 2025, Bitcoin will become a faster and cheaper alternative for millions around the world.

Key benefits:

- Transfers settle in minutes

- Costs are much lower

- No intermediary banks

- Works globally, no matter where you live

Freelancers use it to get paid. Digital nomads use it to move money between countries. Families use it to send support back home.

Because the oneBanking app combines fiat and crypto wallets, users can:

- Send BTC

- Receive BTC

- Convert BTC

- Cash out into euros

This convenience turns Bitcoin into a practical financial tool, not just a speculative asset.

7. High-Value Transactions Made Simpler

High-value payments, real estate purchases, luxury goods, and international invoices are becoming major use cases for Bitcoin.

Why large payments make sense with BTC:

- No chargebacks

- Fast settlement

- Global accessibility

- Transparent, auditable transactions

- No limits based on geography

With hardware wallet integration from Tangem and secure partners ensuring liquidity, oneBanking gives users a safe and compliant environment to move large amounts of Bitcoin without fear of delays or technical issues.

8. Bitcoin as Infrastructure for Tokenized Assets

2025 is the year tokenization goes mainstream, from real estate and equities to commodities and invoices. And Bitcoin is becoming a foundational asset for this transition.

Reasons why Bitcoin works for tokenization:

- High trust

- Strong liquidity

- Deep market infrastructure

- Clear regulatory position

- Widespread global adoption

People increasingly use BTC to collateralize or trade tokenized assets.

Because oneBanking is expanding into ETFs, stocks, digital assets, and precious metals, Bitcoin will serve as a natural and stable bridge between traditional finance and Web3 for its users.

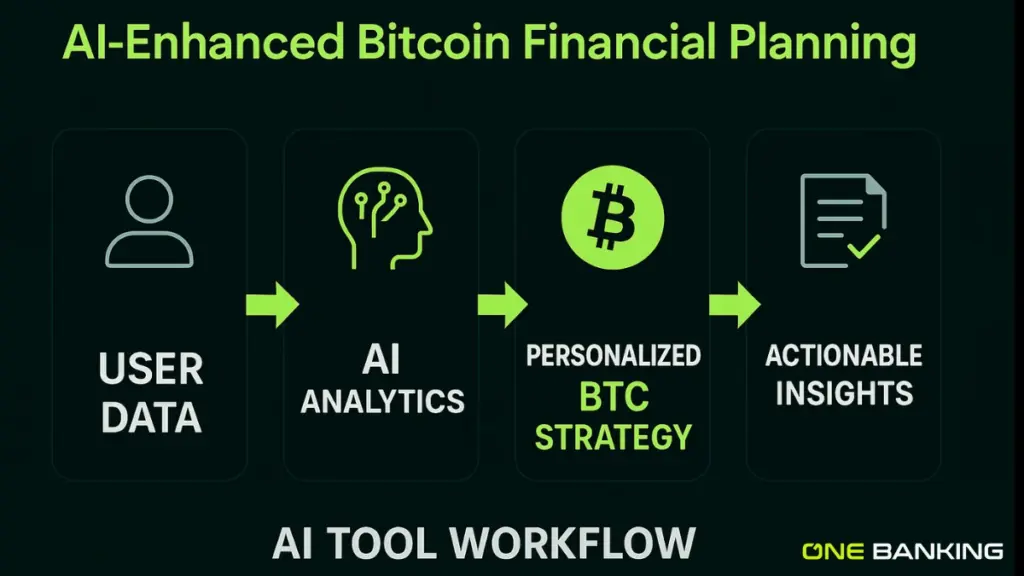

9. AI-Enhanced Bitcoin Financial Planning

Financial planning is changing quickly. People want insights, not guesswork.

AI-powered tools now help users understand:

- When to invest

- How much risk they are taking

- How their Bitcoin fits into long-term goals

- Market sentiment

- Spending vs saving patterns

But here’s the issue: many AI tools collect and misuse personal financial data.

oneBanking app solves this by building a private, secure financial coach that:

- Works 24/7

- Protects personal data

- Helps plan BTC strategies

- Guides decisions using real numbers

- Simplifies complex financial concepts

This makes Bitcoin easier for beginners and more powerful for experts.

10. Bitcoin Rewards for Everyday Activity

One of the most fun and practical use cases in 2025 is Bitcoin rewards.

Users earn BTC for:

- Payments

- Transfers

- Deposits

- Card usage

- App activity

- Crypto transactions

oneBanking app elevates this with:

- App-wide reward multipliers

- Long-term loyalty incentives

- Crypto-linked bonuses

- Extra perks for power users

This transforms Bitcoin from something you buy to something you earn every day, turning simple actions into meaningful rewards.

Conclusion

In 2025, Bitcoin has evolved far beyond digital gold. It’s becoming a universal financial tool that powers payments, investments, corporate finance, lending, AI-driven planning, and global transfers. The Top BTC use cases now reflect real-world adoption, not hype, and the world is finally catching up.

As the financial landscape shifts, oneBanking is positioned at the center of this transformation. With secure licensed partners, built-in crypto and fiat wallets, low fees, global liquidity, AI-powered financial tools, and a unique rewards ecosystem, oneBanking is redefining how people use Bitcoin in their everyday lives.

Analysts predict Bitcoin could reach new all-time highs driven by ETFs, institutional demand, and post-halving supply tightening.

No asset is guaranteed to go 100x. Smaller altcoins may surge, but Bitcoin remains the safest and most fundamentally strong crypto.

Forecasts indicate continued growth as adoption rises, though exact numbers vary by model and market conditions.

Bitcoin leads due to liquidity, security, and global usage. High-potential sectors include AI tokens, L2 networks, and RWAs.

The digital gold narrative strengthens as institutional investors increasingly treat Bitcoin as a long-term, inflation-resistant reserve asset.