Bitcoin mining is the backbone of the Bitcoin network, which is bigger, more complex, and more competitive than ever in 2025. According to CoinDesk, the network’s total computing power (hashrate) recently hit a new record high, surpassing 1 zettahash/sec (1 ZH/s).

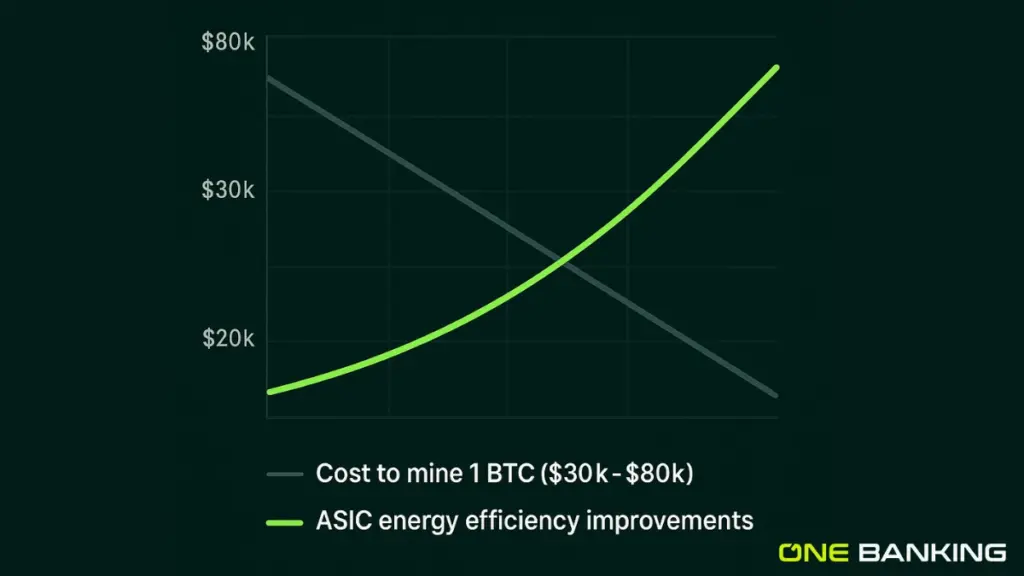

Meanwhile, mining costs have surged: with rising electricity rates and hardware expenses, the cost to mine a single Bitcoin today ranges from roughly $30,000 to $80,000, depending on electricity and efficiency levels.

At the same time, the industry has shifted; institutional mining operations now control a major share of total hashrate, while solo mining by individuals has largely become unviable.

This guide from the oneBanking app will walk you through in a clear, no-fluff way exactly how Bitcoin mining works in 2025, why it matters, what it takes to mine, and whether it still makes sense to try.

What Is Bitcoin Mining?

Bitcoin mining is the process by which new bitcoins are created, and transactions on the Bitcoin blockchain are verified and secured. In a decentralized network without any central ledger keeper, mining ensures that:

- Transactions are validated and recorded

- The ledger remains immutable and tamper-proof

- New bitcoins enter circulation at a controlled, pre-programmed rate

Miners contribute computational power to solve cryptographic puzzles. The first to solve gets to add a new “block” of transactions to the blockchain and earns a reward. That’s Bitcoin mining.

Key Terms You Should Know

| Term | Meaning |

|---|---|

| Public distributed ledger | The full record of all Bitcoin transactions, shared across all nodes on the network. |

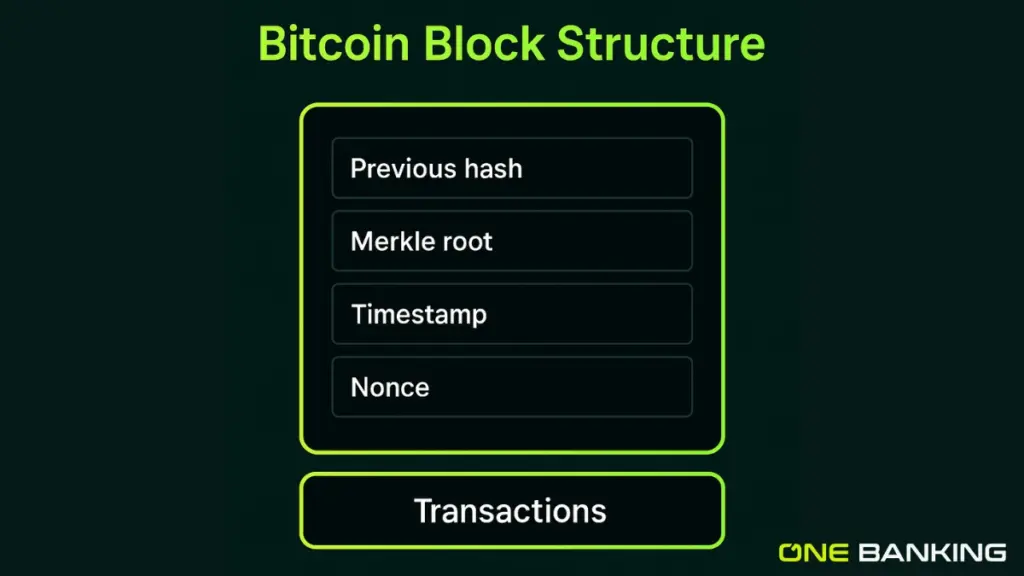

| Block | A package of validated transactions. Each block contains a reference to the previous block, a set of transactions, and a “nonce.” |

| Block reward | The amount of BTC miners receive for successfully mining a block (plus any transaction fees). |

| Hash | A fixed-size output (digital fingerprint) generated from a block’s data. Using the right input and nonce gives a hash under the network’s target. |

| Node | Any computer connected to the Bitcoin network. |

| Nonce | A number of miners repeatedly change to produce different hashes. |

| Proof of Work (PoW) | The consensus mechanism Bitcoin uses—miners compete to find a valid hash under the target difficulty. |

| SHA-256 | The cryptographic hash function Bitcoin uses to secure blocks. |

What are the types of Bitcoin mining (2026 edition)?

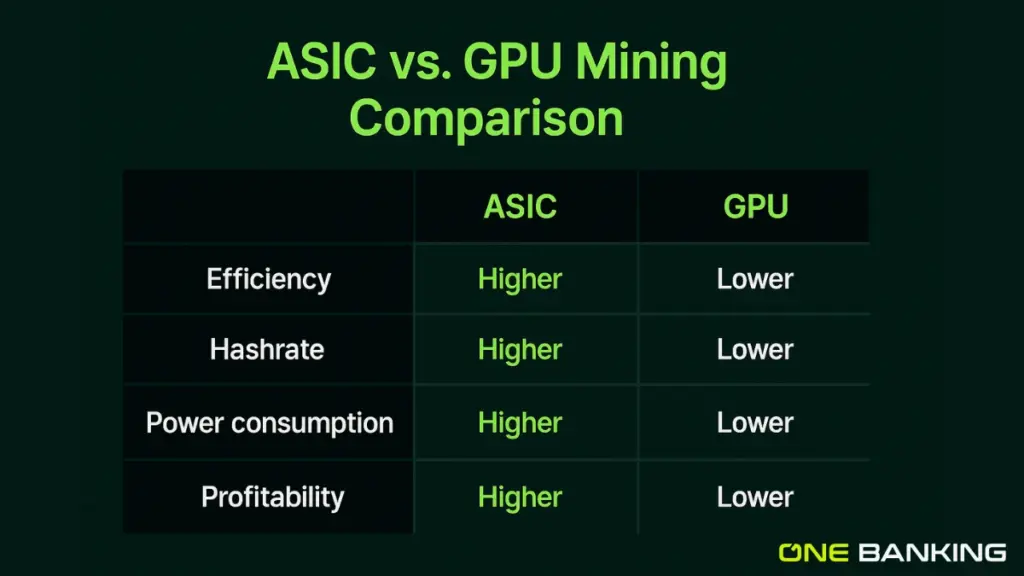

1. ASIC Mining (Dominant Method)

- Most powerful

- Highest efficiency

- Used by all professional miners

2. GPU Mining (Obsolete for Bitcoin)

GPUs no longer work for Bitcoin due to the great difficulty.

3. Cloud Mining

Renting mining power from companies. However, many cloud mining services are scams, so research is essential.

4. Mining Pools

Groups of miners are pooling their computing power to increase the chances of earning rewards.

Top pools (2025):

- AntPool

- Foundry USA

- Binance Pool

How Does Bitcoin Mining Actually Work?

Here’s a step-by-step breakdown of the mining process:

Transactions propagate across the network: When someone sends BTC, the transaction is broadcast and sits in a pool of unconfirmed transactions (the “mempool”).

Miners gather transactions into a candidate block: A miner picks a set of valid transactions and bundles them into a block—along with metadata (previous block reference, timestamp), and a nonce.

Miners repeatedly hash the block header: Using SHA-256, miners generate different hashes by varying the nonce. Their goal: find a hash that is equal to or less than the network’s current target.

The first valid hash wins, and the block is added: The first miner to find a valid hash broadcasts the block. All nodes verify its validity. If approved, the block becomes official and appended to the blockchain.

Block reward is released: As of 2025, the reward per block is 3.125 BTC, plus any included transaction fees. This reward came into effect after the 2024 “halving.”

This process of PoW mining ensures the network remains decentralized, secure, and trustless, without any central authority.

Why Does Bitcoin Need Mining?

Because Bitcoin has no central authority, mining ensures:

- The network is secure

- Transactions are verified

- The ledger stays accurate

- New Bitcoins enter circulation

Mining is essentially the backbone of Bitcoin’s decentralized system.

Who Can Mine Bitcoin in 2026, and How?

1. Solo Mining: Rarely Practical

Unless you have several high-end ASICs and access to very cheap electricity, solo mining is nearly impossible. Even then, the odds of mining a full block are extremely low.

2. Pool Mining: The Common Route for Small Miners

Miners combine hashing power, share costs, and split rewards based on contribution. Consistent payouts, but rewards per miner are small.

3. Cloud Mining / Hosted Mining

You lease hash power from a provider. No hardware or maintenance needed. However, profitability depends heavily on contract terms, fees, and the trustworthiness of the provider.

What are the pros and cons of Bitcoin mining?

Pros

- Profit potential from block rewards and fees

- Supports decentralization

- Ensures transaction security

- Drives innovation in hardware and energy tech

- Promotes financial inclusivity globally

Cons

- Extremely high energy usage

- Expensive hardware

- Regulatory uncertainty in some countries

- Intense competition

- Mining income is volatile, tied to Bitcoin’s price

Bitcoin Mining in 2025: What Has Changed?

Bitcoin mining today is very different from how it used to be.

1. Mining Has Become Institutional

Large corporations run mining farms with:

- Thousands of ASIC miners

- Dedicated power plants

- Specialized cooling systems

They now control the majority of the global hashrate.

2. Mining Difficulty Has Tripled Over Five Years

As more miners join, Bitcoin automatically increases mining difficulty, making it harder to win block rewards.

3. Energy Efficiency Has Improved

Modern ASICs (like the Antminer S21 and WhatsMiner M60) offer 18–25% better efficiency than previous generations.

4. Mining Is Now Region-Dependent

Countries with cheap electricity dominate:

- US (Texas)

- Kazakhstan

- Russia

- Iceland

- UAE

5. Consumer Mining Is Almost Impossible

Regular laptops or GPUs can no longer compete with industrial-scale ASIC power.

How oneBanking App Helps Crypto Users (Even If You’re Not Mining)?

Not everyone can mine, but everyone can invest, manage, and grow their crypto. The oneBanking app supports you in the digital finance world by offering:

- Secure crypto-friendly banking and asset management

- Easy tracking of Bitcoin holdings, gains, and value

- Smart budgeting to integrate crypto and fiat finances

- Transparent tools to monitor investments without complicated mining setups

Whether you are holding BTC, trading, or simply staying updated in crypto, the oneBanking app offers a safe, modern way to manage your finances without dealing with mining hardware or high energy costs.

Final Thoughts

Bitcoin mining in 2025 is a high-stakes, industrial-level operation. The network hashrate has soared past 1 ZH/s, difficulty is sky-high, and efficient ASIC rigs plus cheap electricity have become prerequisites. For most individuals, solo mining is no longer practical; pool or institutional mining dominates.

If you’re entering the world of Bitcoin today but don’t want the hassle of mining hardware, energy bills, or technical setup, consider focusing instead on managing your crypto assets smartly. With the oneBanking app, you get a user-friendly, secure, integrated platform to hold, track, and manage Bitcoin and fiat, no mining rigs required.

Bitcoin mining remains the engine of the blockchain, but for many, smart asset management is the smarter path forward.

Bitcoin mining is the process of verifying transactions and creating new blocks using powerful computers. Miners earn BTC as rewards.

Miners solve cryptographic puzzles using ASIC hardware. The first to solve the puzzle adds a new block to the blockchain and receives BTC rewards.

No. It is legal in most countries, including the US, the EU, and India. Some countries restrict it due to energy concerns.

Get ASIC hardware → install mining software → join a mining pool → set up a wallet → start mining → receive payouts.

It depends on hardware and electricity. On average, mining farms take 30–90 days to mine 1 BTC collectively.

No. Mobile devices lack the computing power needed for real mining. Most “mobile miners” are reward apps, not actual mining.