With a lot more banking becoming digital across Europe, companies are accelerating their investment in innovation to meet the rising expectations of their customers. Over a decade, the number of Europeans using online banking jumped from 42% to 67%, according to Eurostat figures that go as high as 75% in countries such as Spain. This surge ushers in a new era for financial services—one defined by mobile-first experiences, artificial intelligence, and integrated finance.

The change is being led by oneBanking, a new digital banking app merging traditional finance with next-generation technology. By design, it integrates fiat, crypto, and investments into one platform, making oneBanking a new generation of finance apps for the way modern-day people manage their money.

Europe’s Digital Banking Momentum

The European banking landscape has changed dramatically: customers no longer regard digital access as an added convenience but as a given. As the Basel Committee on Banking Supervision recently noted, technological innovation is reshaping the entire system, creating new channels for financial services and redefining how banks operate.

The shift has been swift. Driven by consumer demand for instant payments, real-time insights, and frictionless international money transfers, mobile banking usage is growing every year across the EU. Meanwhile, regulatory regimes such as PSD2 and open banking have opened the door for fintech innovators like oneBanking, offering services that go beyond traditional banking.

Bridging Traditional and Digital Finance

If other, older institutions have to adapt themselves to the new technology, then oneBanking has built its foundation upon it: an integrated banking, crypto, and investment feature on one platform that fits the modern lifestyle.

One secure app enables users to hold fiat accounts, manage their crypto assets, send payments, and make investments. Such a solution will make financial management simple and easy without needing to juggle multiple tools or platforms.

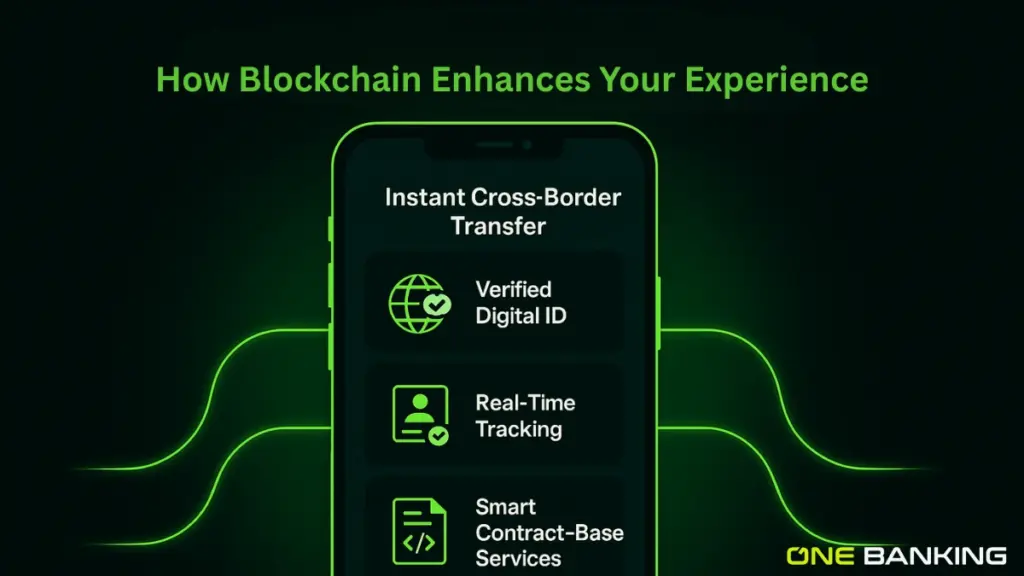

Where conventional banks often struggle with modernizing legacy systems, oneBanking has designed its infrastructure with agility in mind: natively digital means an ability to scale rapidly, without friction, adopting new technologies such as AI and blockchain.

AI: The Engine Behind Smarter Banking

Artificial intelligence is becoming the cornerstone of modern financial services. oneBanking is harnessing AI not just as a feature but as a driver of intelligence across its platform.

Its upcoming AI-driven personal finance assistant will analyze spending behavior, identify savings opportunities, and provide predictive insights to help users make informed financial decisions. The technology will also power risk management, automate security monitoring, and streamline compliance.

Across Europe, this AI-first approach mirrors a wider industry shift. The World Economic Forum has noted that automation and analytics are reshaping how institutions interact with customers, replacing manual processes with smarter, data-led systems that increase transparency and efficiency.

Security and Trust: The Foundation of Growth

As digital finance expands, so too does the need for strong safeguards. oneBanking’s approach centers on transparency and security, ensuring users’ assets are protected through partnerships with licensed and audited financial institutions.

The company works with established partners, including BVNK Services, OKX, and Kraken, ensuring both fiat and crypto assets are managed in line with European regulatory standards. This model reflects oneBanking’s belief that innovation and compliance must go hand in hand.

With Europe’s regulators reinforcing strict guidelines for digital transactions, such practices are critical to maintaining customer confidence. oneBanking’s infrastructure is built to meet that challenge—combining encryption, multi-factor authentication, and continuous monitoring to secure every user interaction.

Rewarding Everyday Banking

oneBanking is changing the meaning of engagement in finance. The application offers a reward system: bonus points are awarded for performing everyday activities, from transfers and payments to crypto transactions.

With this approach, customers have an incentive for responsible financial behavior, and they know that banking is not a chore but rather a reward. This is part of the bigger strategy to make financial services more engaging, matching the incentives with the way users engage digitally.

By combining convenience with real value, oneBanking can provide a customer experience not often found with any traditional bank: personal, rewarding, and built for participation.

Empowering a Digitally Skilled Europe

Europe’s readiness for this transformation is plain. There is digital maturity: 66% of EU citizens possess basic digital skills, according to the European Commission’s State of the Digital Decade report, while nearly 10% of companies deploy AI tools to improve operations.

In this regard, oneBanking’s expansion follows the ambition of leading in digital finance in the region. Its vision thus supports the wider economic strategy of Europe, one that fosters digital sovereignty, sustainability, and inclusion.

While governments make investments in the areas of digital upskilling and cybersecurity, fintech companies like oneBanking become significant partners in driving technological progress and financial literacy.

A Blueprint for the Best Finance App

The future best finance app won’t just manage accounts but will anticipate needs, personalize experiences, and operate securely across multiple asset types. oneBanking’s model represents this blueprint.

The roadmap incorporates expanded AI capabilities, integration with real-world asset investments, and an extended suite of tools for both retail and professional users. Agility and simplicity are core to its design philosophy: power without complexity, intelligence without compromise.

Through the blending of innovation and a strong compliance culture, oneBanking positions itself not merely as another fintech player but rather as a credible alternative to the traditional bank.

The Next Phase of European Finance

Europe’s financial transformation is far from over. With digital ecosystems becoming more interconnected, partnerships between fintechs and traditional banks are likely to grow. Platforms like oneBanking demonstrate how technology can coexist with established systems, enhancing rather than replacing them.

As customers embrace new digital behaviors, trust and innovation will remain central to success. oneBanking’s balanced approach, uniting cutting-edge features with regulatory rigor, positions it as a leader in Europe’s next phase of digital banking.

Conclusion

A future of banking in Europe is being written by innovators who understand technology and trust. oneBanking stands at that intersection. Merging AI, security, and multi-asset management into one digital banking application is transforming the ways in which Europeans interact with their money.

oneBanking is representative of a platform of progress instead of a product and offers clear insight into what financial freedom should look like in the light of digital evolution on the continent.