I’ll be honest, I didn’t expect this one. BNY Mellon, the oldest bank in America and the world’s largest custodian, just stepped directly into the blockchain era.

We’re talking about a 240-year-old institution managing $55.8 trillion in assets, now testing tokenized deposits, digital versions of real bank money that move across blockchain rails.

This isn’t a crypto startup or another experimental pilot; this is legacy finance rewriting itself before it gets replaced.

Because here’s the brutal truth: banks finally realized they can’t compete with blockchain. So now they’re becoming it.

The Turning Point

BNY Mellon moves $2.5 trillion in payments every single day. That’s the invisible plumbing behind the global economy.

Now imagine that flow of money moving instantly, with no SWIFT delays, no correspondent fees, and no “check back Monday morning.” That’s not just a tech upgrade. That’s a monetary transformation.

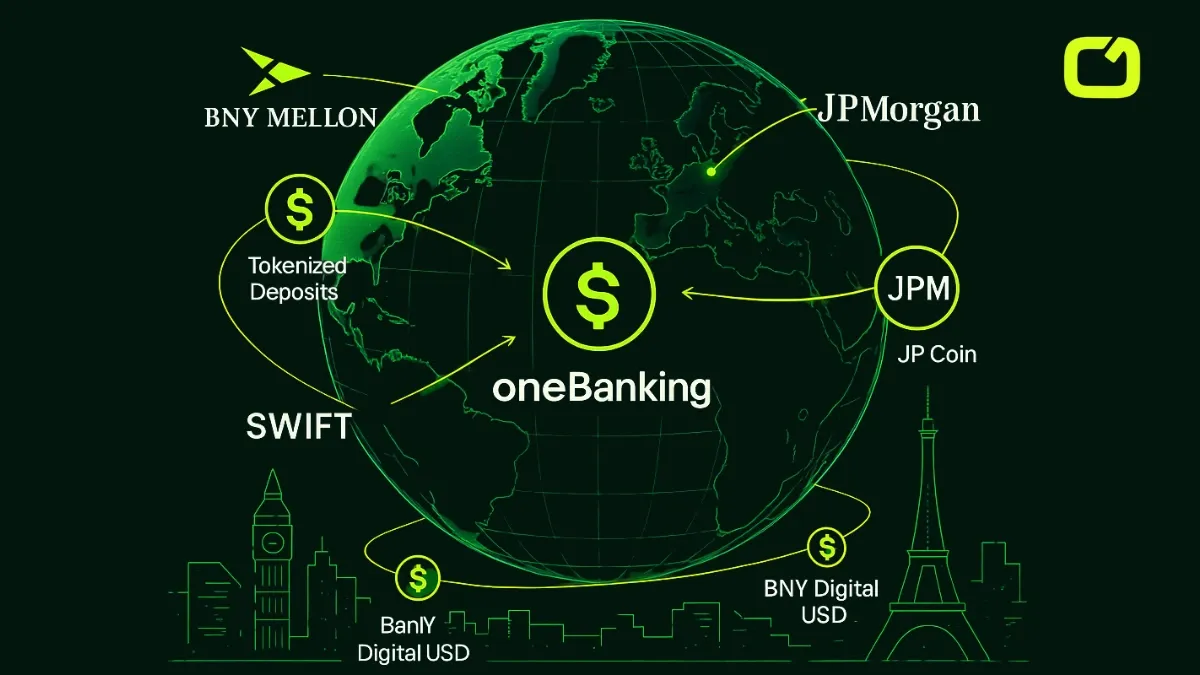

And it’s not happening in isolation: JPMorgan has its JPM Coin, HSBC is running its own digital cash pilot, and even SWIFT is testing a shared-ledger prototype. Every major bank on earth is preparing for the on-chain era.

This is no longer about “crypto adoption.” This is about institutional survival.

So What Are Tokenized Deposits, Really?

Think of them as bank-issued stablecoins, each one backed 1:1 by real commercial bank money.

They’re fully regulated. They’re interoperable across blockchains. And they settle instantly, 24/7.

In other words, they combine the trust of the old system with the efficiency of the new one.

And that’s a huge deal, because tokenized deposits could completely redefine how liquidity, settlement, and risk management work worldwide.

Why It Matters

Here’s why this moment matters more than most people realize:

- Liquidity: Banks can move cash dynamically, 24/7, without waiting for business hours or settlement windows.

- Settlement: Trades can clear in seconds, reducing counterparty and collateral risks that used to take days.

- Risk Management: Real-time data and programmable money make it easier to manage exposures and compliance.

- Efficiency: Fewer intermediaries, lower friction, faster movement of trillions in value.

That’s not fintech innovation; that’s the operating system of global money being rebuilt from the inside out.

Innovation by Legacy or by Necessity?

Here’s the question I can’t stop thinking about: Is this innovation driven by vision or by desperation?

Because let’s be honest, banks didn’t wake up one day wanting to “build on blockchain.” They’re doing it because they finally accepted they can’t outrun it.

SWIFT is slow. Settlement systems are outdated. Regulations are heavy.

So instead of being disrupted, they’re absorbing the disruption. Instead of competing with blockchain, they’re merging with it.

BNY Mellon isn’t chasing crypto; it’s chasing survival.

The Irony of It All

Crypto wanted to replace the banks. Now the banks are turning crypto into their next product line.

First they ignored it. Then they mocked it. Now they tokenize their deposits.

BNY Mellon isn’t “testing the future.” It’s merging with it.

That’s the point of no return for global finance. Even the most traditional institutions are running on blockchain rails.

Where oneBanking Fits In

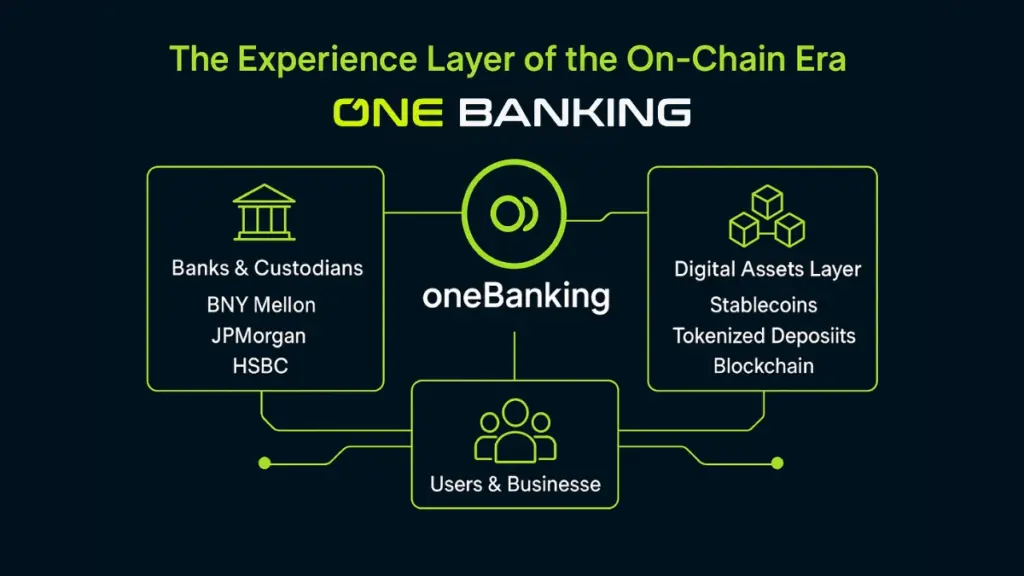

For me, this shift confirms exactly why we’re building OneBanking.

As the world’s largest banks start running on blockchain, the rails of money are changing fast, but the user experience still hasn’t caught up.

That’s the gap we’re filling.

We’re not another protocol or trading app. We’re building the bridge between traditional finance and this new digital layer connecting fiat, stablecoins, and tokenized assets in one seamless place.

And with AI at the heart of oneBanking, we’re making this complexity invisible.

We help users see where their money moves, anticipate what’s next, and make smarter decisions across both the old world and the new one.

BNY Mellon is upgrading the infrastructure. We’re upgrading the experience.

Because in a world where $55 trillion moves on-chain, people won’t just need faster money.

They’ll need smarter money.

Welcome to the new monetary order. Even 240-year-old banks are now becoming blockchain, and OneBanking is here to help everyone else catch up.

FAQ

What are tokenized deposits?

Tokenized deposits are digital versions of traditional bank deposits that exist on a blockchain. Each token represents real money held in a commercial bank account and is backed 1:1 by cash. They’re like blockchain-powered bank money fully regulated, instantly transferable, and interoperable with other on-chain assets.

Unlike stablecoins, which are usually issued by private companies, tokenized deposits stay inside the regulated banking system, giving them credibility with both regulators and institutions.

Why is BNY Mellon exploring tokenized deposits?

BNY Mellon, the world’s largest custodian, holding $55.8 trillion in assets processes about $2.5 trillion in payments daily. By using blockchain, they can move that money instantly, reduce settlement risk, and eliminate the friction of systems like SWIFT or Fedwire. This isn’t a crypto experiment; it’s about modernizing the plumbing of global finance before it becomes obsolete.

Simply put: banks like BNY Mellon aren’t chasing blockchain hype; they’re embracing blockchain to stay relevant.

How do tokenized deposits differ from stablecoins like USDT or USDC?

- Issuer: Tokenized deposits are issued by regulated banks; stablecoins are issued by private companies.

- Backing: Both are backed 1:1 by cash or equivalent reserves, but deposits sit under banking law, not securities or trust structures.

- Use case: Stablecoins dominate trading and crypto liquidity. Tokenized deposits will dominate institutional settlements and cross-border payments.

- Regulation: Tokenized deposits are fully compliant under existing bank regulation, whereas stablecoins face jurisdictional uncertainty (MiCA, SEC, etc.).

In short, stablecoins are fintech money. Tokenized deposits are bank-grade digital money.

Why are banks moving onto blockchain rails?

Because they finally realized they can’t compete with blockchain so they’re becoming it.

Legacy systems like SWIFT are slow, expensive, and limited to business hours.

Blockchain offers real-time settlement, transparent records, and programmable payments.

Banks aren’t doing this because they want to disrupt themselves; they’re doing it out of necessity.

This shift isn’t about crypto adoption; it’s about institutional survival in a world that now expects 24/7 financial infrastructure.

How will tokenized deposits change global liquidity and settlement?

Tokenized deposits could completely reshape how money and assets move worldwide.

Here’s how:

- Liquidity: Cash can move instantly, freeing up trillions locked in intraday positions.

- Settlement: Trades can clear in seconds, reducing collateral needs and settlement risk.

- Risk Management: Real-time transparency gives banks better insight into exposures and liquidity flows.

In short, tokenized deposits could make global finance as fast and composable as the internet itself.

Which banks are leading the move toward tokenized deposits?

Several major players are already deep into this transformation:

- BNY Mellon – testing tokenized deposits and blockchain settlement for $2.5T in daily payments.

- JPMorgan – expanding JPM Coin for institutional clients globally.

- HSBC – piloting tokenized cash and asset tokenization solutions.

- SWIFT – building a shared ledger prototype for blockchain-based settlement.

This isn’t a niche trend anymore, it’s the new infrastructure race among global banks.

Will tokenized deposits replace stablecoins?

Not entirely. They’ll coexist serving different needs. Stablecoins will continue dominating crypto markets and decentralized finance. Tokenized deposits will dominate institutional money movement, cross-border payments, and interbank liquidity.Think of them as parallel systems one driven by traders and fintech, the other by regulated banking infrastructure.

What does this mean for everyday users?

Right now, tokenized deposits are an institutional story but the effects will trickle down fast. When banks move to blockchain rails, payments, remittances, and cross-border transfers become faster, cheaper, and more reliable for everyone. That’s where oneBanking fits in building the platform that makes these new rails simple, accessible, and intelligent for real people.

Our mission is to make sure that the next generation of digital money doesn’t just move faster it works smarter for you.

Is blockchain really the future of banking?

Yes and it’s already happening. BNY Mellon’s move proves that blockchain isn’t a competitor to banks anymore it’s becoming their core infrastructure.The financial system isn’t being replaced by blockchain It’s merging with it.

We’re witnessing the biggest upgrade to the global money movement in centuries.

First, banks ignored it.Then they mocked it. Now they’re building on it.

How does oneBanking fit into this on-chain future?

oneBanking is being built for exactly this moment.

As legacy institutions move on-chain, users will need a bridge something that connects fiat, stablecoins, and tokenized assets in one intelligent app.

That’s oneBanking.

We’re not a bank, we’re the interface:

- Simple access to both traditional and digital assets.

- AI-driven insights that make complex money flows understandable.

- A unified experience that helps users navigate the biggest financial shift in modern history.

In a world where $55 trillion is going on-chain, oneBanking ensures you don’t get left behind.

Will blockchain make traditional banks obsolete?

Not necessarily but it will change what it means to be a bank. The institutions that survive won’t be the ones with the biggest balance sheets. They’ll be the ones that can innovate, adapt, and connect to the new financial rails.

BNY Mellon is proof that even 240-year-old banks can evolve and oneBanking is proof that users don’t have to wait for them to catch up.